Introduction

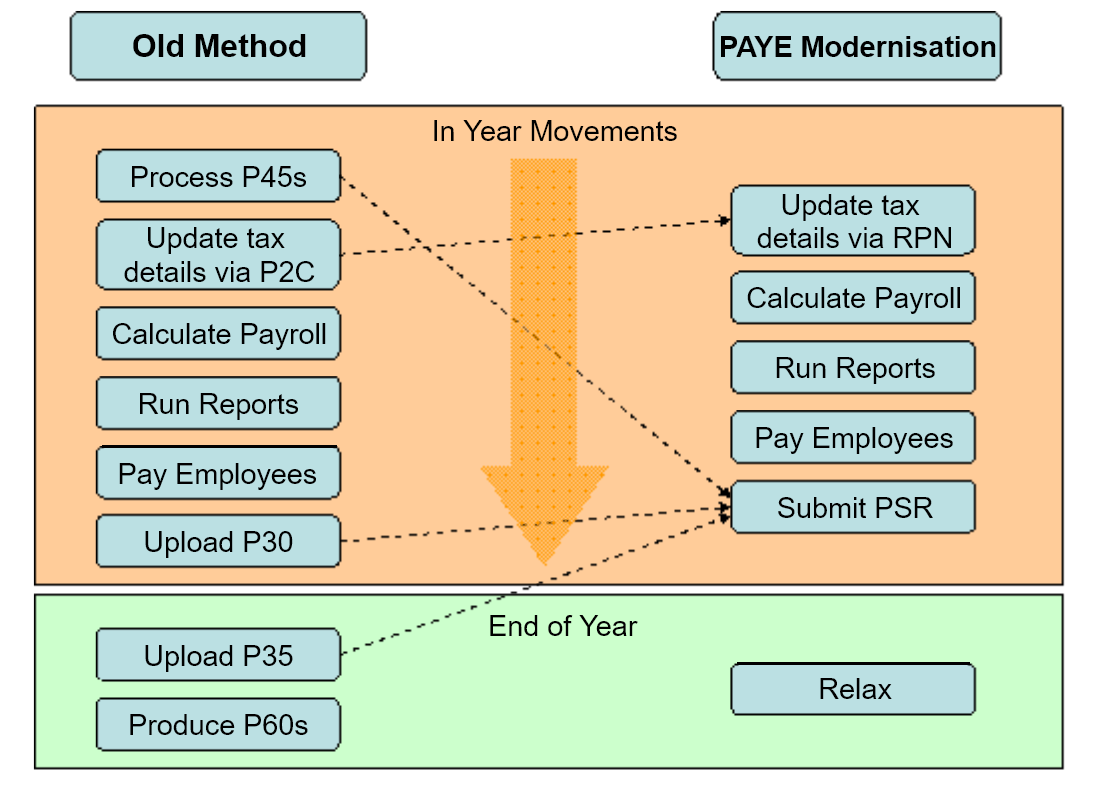

PAYE Modernisation is a new procedure for processing payroll. Instead of downloading or typing in Tax Credit (P2C) information, this is now downloaded from the Revenue Server. P2Cs or Tax Credit certificates are now called RPNs. When you have processed your payroll for a pay date, now you have to submit all the information to Revenue. P35s, P45s and P60s have been done away with for 2019 onwards (You still have to do P60s and P35 for 2018). Revenue will know when there is a employee leaving via the submission you make. There are two parts to PAYE Modernisation:

- Download and update RPNs

- Submit Payroll information to Revenue

You will still pay Revenue in the same way, on the same date as your existing P30.