Introduction

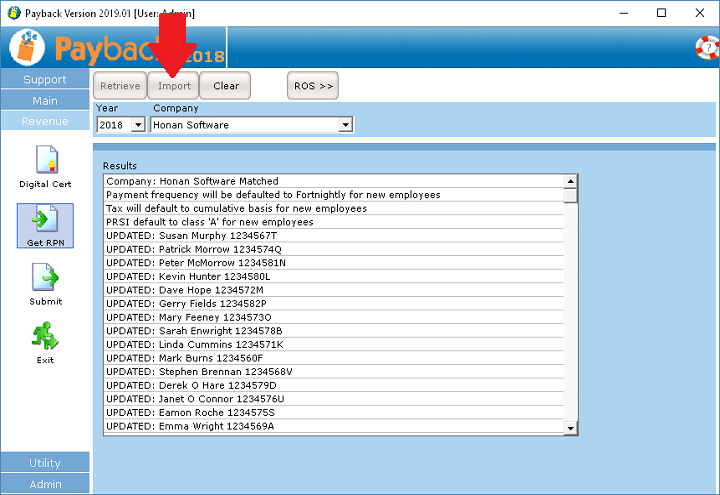

Revenue suggest that employees' tax details should be updated prior to each pay run. You can do this in Payback using the new RPN screen.

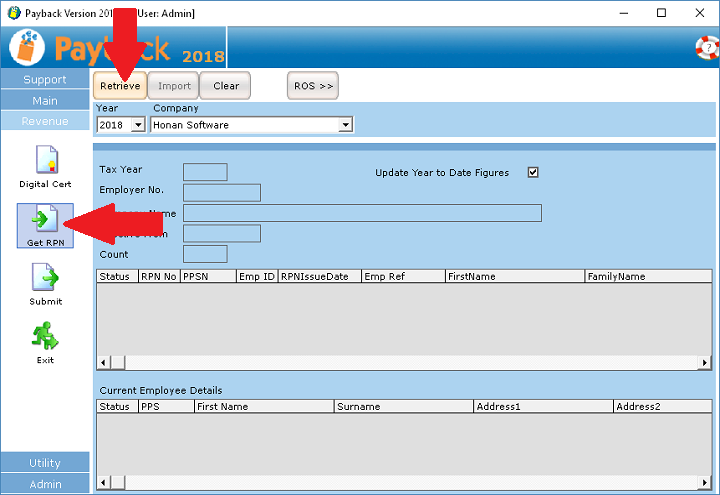

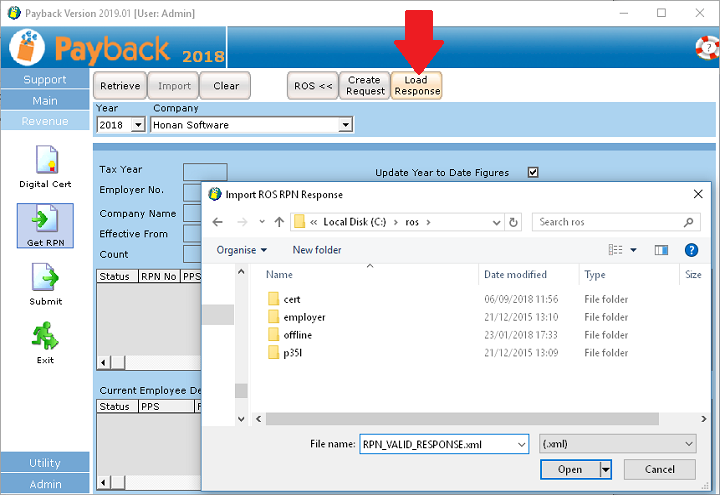

The Tax credits import screen has been replaced by the RPN (Revenue Payroll Notification) screen. We have tried to make this function in the same way as the old Tax Import screen, with a couple of improvements.

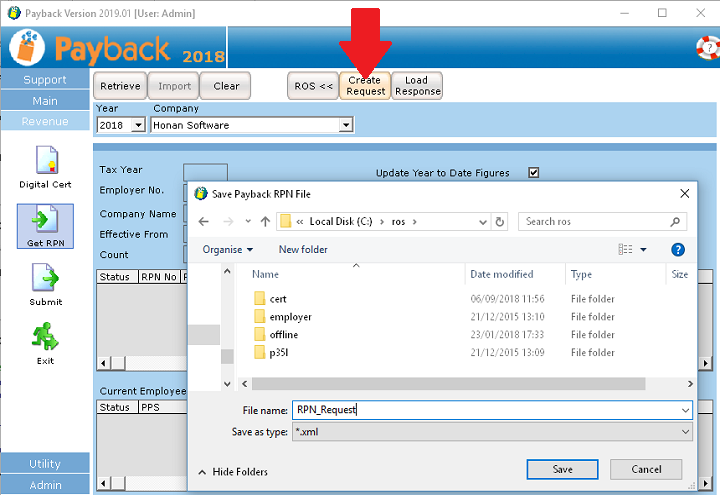

The screen has two grids on it. The top grid displays the information retrieved from Revenue (either via a ROS response XML file or via Direct Reporting). The second grid displays all of your employees with their current tax details.

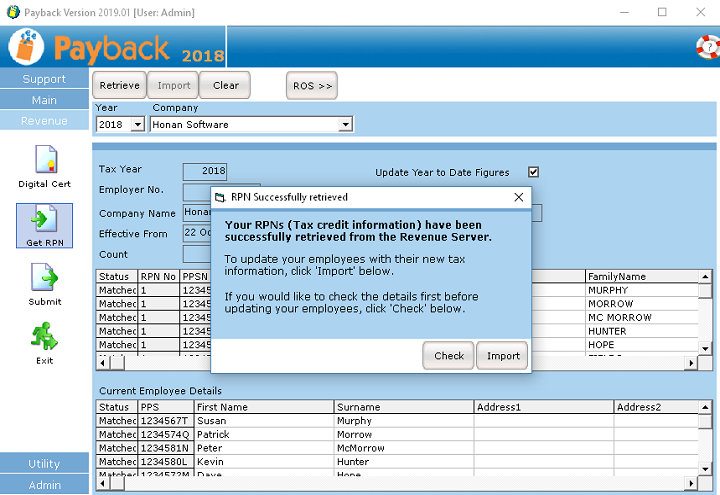

When you retrieve your tax details from Revenue a message box now appears giving the option to update your employees. This is to inform users that the employees will not be updated until the Import button has been clicked.