Chapter Seven: Pensions, loans and other Voluntary Deductions

CIF Pensions (Construction Industry Federation)

Setting up a Voluntary Deduction

Chapter Seven: Pensions, loans and other Voluntary Deductions

Setting up a Pension

AVC, RAC and PRSAs

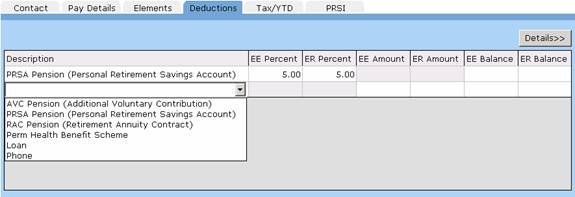

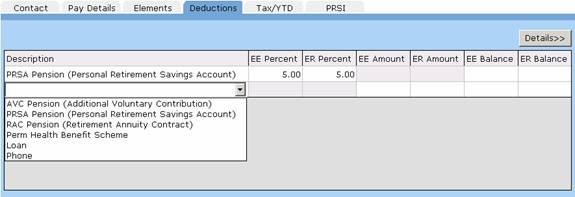

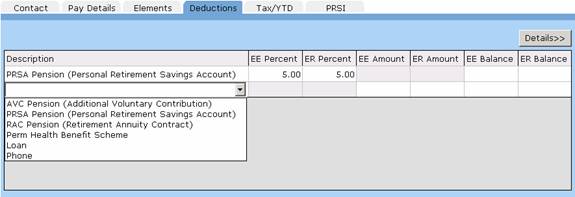

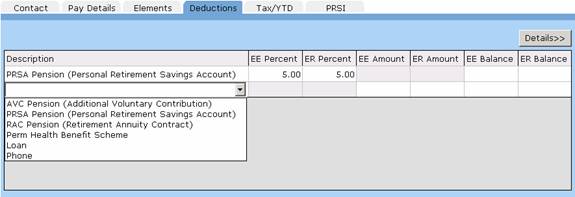

Pensions are set up as voluntary deductions. Click on the ‘Deductions’ tab in the Employee screen. Pensions are an on-going deduction so they should be set up from the Employee screen rather than the Payroll screen.

- Click the Employee icon on

the main menu at the left of the screen.

- Select the employee you wish to set the pension up for from the list of

employees.

- Click on the Deductions tab near the bottom half of the screen

- You will be able to see the voluntary deductions grid

- Click on the empty white cell under the 'Description' column, a drop-down

arrow will appear.

- Click the arrow to display the deductions.

- Select the Pension type (AVC, PRSA or RAC) from the list. Note that for the

2005 P35, this pension type information is required.

- Fill in the pension details into the other columns. You can set up a pension

as a percentage of gross pay, or as a flat amount. Payback defaults to

percentage amount.

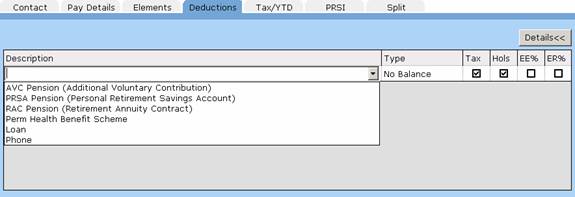

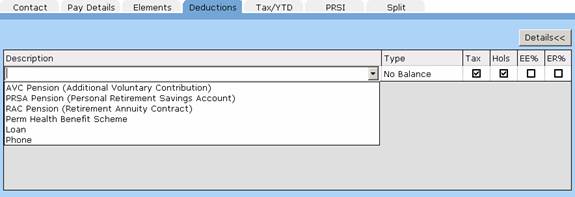

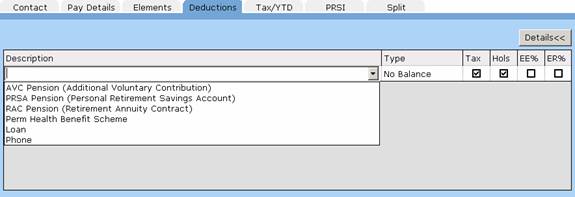

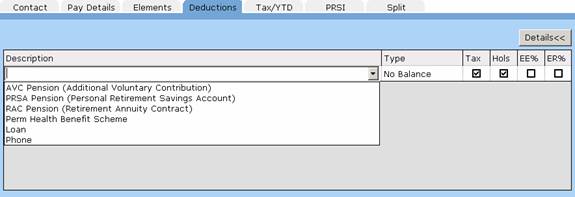

To change to flat amount, click the ‘Details>>’ button near the top of the deductions grid.

- under EE% and ER%, uncheck the boxes. This will allow you to enter flat amounts

- Click the ‘Details<<’ Button to input the values.

EE Percent = Employee contribution as a percentage of gross pay

ER Percent = Employer contribution as a percentage of gross pay

EE Amount = Employee contribution as a flat amount

ER Amount = Employer contribution as a flat amount

EE Balance = Total employee contribution

ER Balance = Total employer contribution

-When you have finished filling in the amounts, click on the 'Update

Employee" button at the top of the screen

- Click the 'Payroll' icon on the menu at the left of the screen.

- Select the period to pay and the employee you have just set the pension up

for.

- Note that the pension deduction has been successfully set up.

(A pension deduction is none-taxable)

CIF Pensions (Construction Industry Federation)

CIF Pensions have to be processed as two deductions, a taxable deduction and a non-taxable deduction. To find the appropriate rates for the scheme, please contact the Construction National Joint Industrial Council (CNJIC).

The Pension Benefit and the Death in Service Benefit are both non-taxable. The Sick Pay Benefit is taxable.

CIF Pensions are an on-going deduction so they should be set up from the Employee screen rather than the Payroll screen.

- Click the Employee icon on

the main menu at the left of the screen.

- Select the employee you wish to set the CIF pension up for from the list of

employees.

- Click on the Deductions tab near the bottom half of the screen

- You will be able to see the voluntary deductions grid

- Click on the empty white cell under the 'Description' column, a drop-down

arrow will appear.

- Type ‘CIF Pension’ into the cell.

- CIF Pensions are paid as a flat amount, so type the Employee’s contribution

under the column heading ‘EE Amount’. Type the Employer’s contribution under

‘ER Amount’. Leave the ‘Balance’ fields blank.

- Click the ‘Details>>’ button near the top of the deductions grid.

- Untick the ‘Tax’ box. This portion of the CIF Pension is not taxed.

- Click the ‘Details<<’ button again to set up the second portion (Sick Pay)

- Select the blank cell under the row you just input.

- Type ‘CIF Sick Pay’ into the cell.

- Input the Employee and Employer contributions in the same way as you did for the CIF Pension (These will default to flat rates, and not percentages)

- Click the ‘Details>>’ button again to check that the

‘Tax’ box is ticked. This portion has to be taxed.

- Click on the 'Update Employee" button at the top of the screen to save

your changes

- Click the 'Payroll' icon on the menu at the left of the screen.

- Select the period to pay and the employee you have just set the pension up

for.

- Note that the pension deduction has been successfully set up. There should be

two rows, ‘CIF Pension’ and ‘CIF Sick Pay’.

Setting up a Loan

An employee loan is set up as a voluntary deduction. Click on the ‘Deductions’ tab in the Employee screen. Loans are an on-going deduction so they should be set up from the Employee screen rather than the Payroll screen.

- Click the Employee icon on

the main menu at the left of the screen.

- Select the employee you wish to set the pension up for from the list of employees.

- Click on the Deductions tab near the bottom half of the screen

- You will be able to see the voluntary deductions grid

- Click on the empty white cell under the 'Description' column, a drop-down

arrow will appear.

- Click the arrow to display the deductions.

- Select ‘Loan’ (This description may be over-written)

- Fill in the loan details into the other columns. You can set up the

repayments as a percentage of gross pay, or as a flat amount. Payback defaults

to flat amount.

To change to flat amount, click the ‘Details>>’ button near the top of the deductions grid.

- under EE% and ER%, tick the boxes. This will allow you to enter repayments as a percentage of gross pay.

- Click the ‘Details<<’ Button to input the values.

- The ‘Balance’ refers to the amount of the loan. This will

reduce on the payslip with each repayment.

-When you have finished filling in the amounts, click on the 'Update

Employee" button at the top of the screen

- Click the 'Payroll' icon on the menu at the left of the screen.

- Select the period to pay and the employee you have just set the loan up for.

- Note that the loan deduction has been successfully set up.

(A loan deduction is taxable)

Setting up a Voluntary Deduction

You can set your own voluntary deductions up like union fees or Christmas savings funds. To set up a voluntary deduction, click the ‘Deductions’ tab. If it is going to be an on-going deduction (like a Christmas savings fund) set it up in the employee screen. For a once-off deduction, set it up while you are processing the payroll, in the Payroll screen.

- You will be able to see the voluntary deductions grid

- Click on the empty white cell under the 'Description' column and type the

name of the deduction (eg. Christmas Fund)

- Click the ‘Details>>’ button near the top of the deductions grid.

- Select the type. For a Christmas savings fund, you probably want the balance to be increasing so that you can see how much the employees have paid into the fund. Select ‘Increasing’

- Tick the ‘Tax’ column. Most voluntary deductions will have tax applied.

- If you want the employee to contribute to the fund while they are on holiday, tick the ‘Hols’ box. Contributions will be automatically taken out of their holiday pay.

- under EE% and ER%, tick the boxes is you wish to enter contributions as a percentage of gross pay. Leave them unchecked if you want to enter flat amounts.

- Click the ‘Details<<’ Button to input the values.

EE Percent = Employee contribution as a percentage of gross pay

ER Percent = Employer contribution as a percentage of gross pay

EE Amount = Employee contribution as a flat amount

ER Amount = Employer contribution as a flat amount

EE Balance = Total employee contribution

ER Balance = Total employer contribution

-When you have finished filling in the amounts, click on the 'Update

Employee" button at the top of the screen

Whenever you run the payroll for this employee, they will have a Christmas savings fund deduction.