Note that this information is for reference purposes only, and may now be out of date.

Introduction

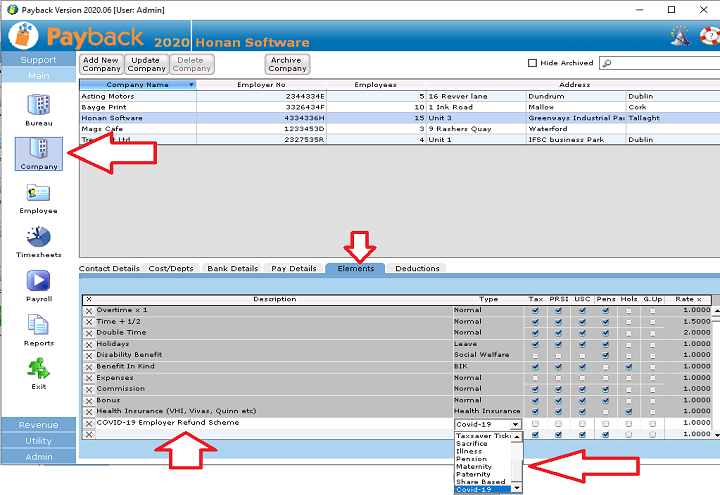

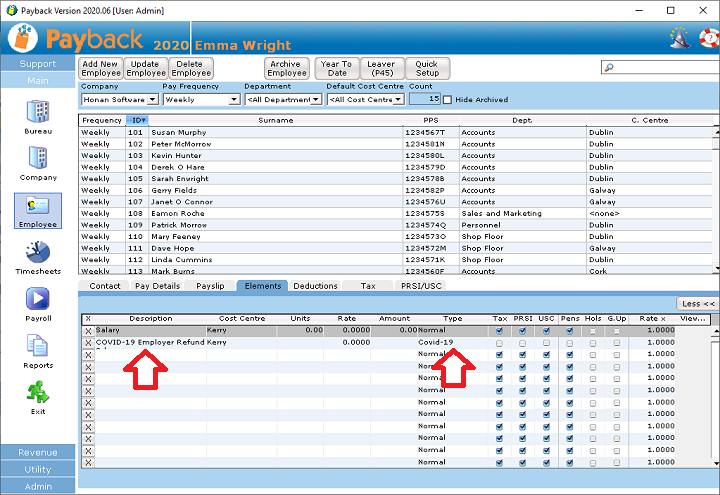

We are working on new versions of both CloudPay and the desktop software that will be able to accommodate the new Covid-19 changes.

However, we have had no advance notice of these changes and are being updated by Revenue at the same time as everyone else.

It is also a very much changing and evolving situation.

We expect the new versions to be ready by the end of this week

We will issue full instructions on how to operate the scheme as soon as we release the new versions.

Refund Scheme

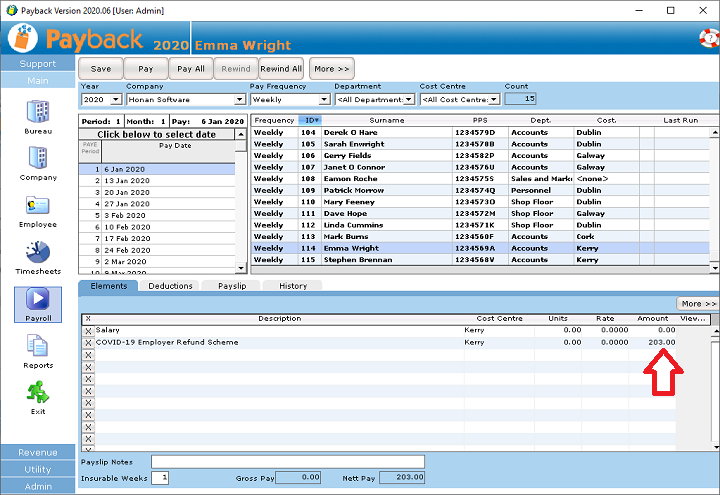

Employers can either temporarily lay-off employees or continue to pay them €203 per week which is refundable under a new Employer COVID-19 Refund Scheme

https://www.gov.ie/en/publication/612b90-covid-19-information-for-employers/

If you decide to lay off your employees, will need to process cessations in the usual way so that employees can make a Jobseekers claim with DEASP.

The preferred option is to avail of the new Refund Scheme.

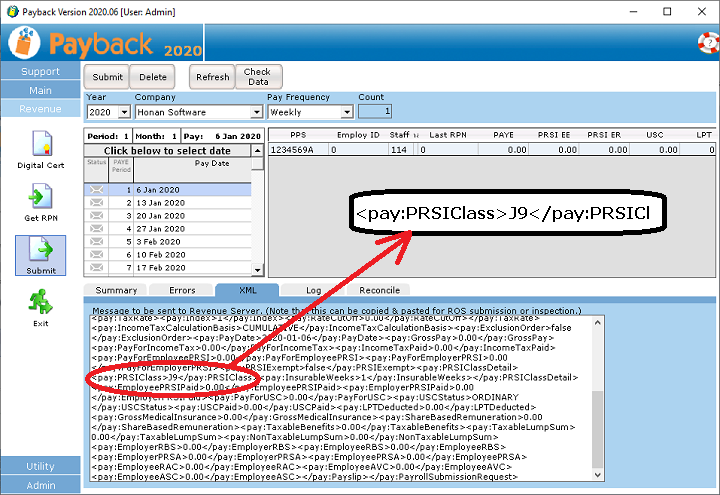

Payment are to be reported under PMOD using PRSI subclass J9. Note that you will not be able to allocate J9 to payments using the existing versions of Cloudpay or the desktop version.

e-working workday allowance

In additional to the refund scheme, we will also be adding a new e-working workday allowance element to cater for all the workers who are now working from home.

Refund Scheme FAQ

How do you prove that the employer has paid the employee the €203?

The employer signs up for the scheme and agrees to operate the scheme rules. The employee will see the payslip on myAccount and we will mark such payment so employee knows they should have received €203 from the employer.

Will the €203 refund, and the refund to cover employee tax refunds be paid together?

Yes a single refund will be made to the employer to include the €203 plus tax and USC.

What are the amounts for each pay frequency?

- Weekly - €203

- Fortnightly - €406

- Monthly - €812– 4 weeks for march

- Four-Weekly - €812

- Twice-Monthly – €406 – 2 weeks for March

- Quarterly – N/A

- Bi-Annual - N/A

- Week-based Monthly - €812

- Annual – N/A

- Other – N/A

Is the 203 based on calendar week or Revenue week number? In regard to people who go onto scheme part way through a week and get 1/7th 1/5th?

The scheme start from the start of a week

People paid less than €203 per week still entitled to full €203?

Yes all employees entitled to €203 regardless of normal salary

Why do you need the taxable pay of 0.01, can employers just pay the non-taxable pay for 203 , in addition , would the pay for USC and Pay for PRSI be needed to be reported as 0.01

The 0.01 was to trigger the payroll event for certain payroll software. You do not have to do this for CloudPay or the desktop version.

Is the scheme limited to a maximum of 6 weeks?

This is the initial intent

Are there qualifying PRSI contribution requirements to be satisfied?

No there is no qualification criteria on previous PRSI contributions

Do you want the value of €203 to appear anywhere in the submission? Or is it presumed?

It is presumed. We calculate the amount pay by using the J9 class and the pay frequency. Note that both Cloudpay and the desktop version will both automatically fill in the appropriate fields for the PSR.

If an employee receives two weeks normal pay and is then absent for the remainder of the month and due the 203, what class would they be placed on as they've received some pay in that period?

The J9 class applies to the full month submission for the PSR.

How will Revenue know how many €203s to refund e.g. on Monthly where part of the month is salary?

(Under review by Revenue)

For the monthly scenario with a part payment of earned wages, how will you determine how many 203 payments have been made?

(Under review by Revenue)

Does the employee application for this payment have to be evidenced to the employer before they begin processing, to avoid fraudulent claims?

Employer’s submission is the employee application. The employee does not have to do anything. Review of payments will be done at a later data and if fraudulent activities monies can be recoup through tax.

Should relevant employees be converted to weekly?

It may be easier for employer to move to weekly payroll and Revenue has no issue with this but it is not a pre-requisite either.

For months (some 4 weeks some 5) do we just pay 203x4 or 203x5

March is 4 weeks. Revenue will review April as maybe 5 weeks.

Can the employer top up this scheme?

No top ups on this scheme

Should Net Deductions (LPT, Bike To Work, Bus Tickets etc) be deducted from the Net Pay by the employer?

No deductions should be made from the 203 net pay

Should all BIK be suspended for now? e.g. id employee has car while laid off?

Yes is no other payment than 203 then no BIK. Employees still being paid normally BIK still applies.

Do we record insurable weeks as zero against J9?

No normal insurable weeks i.e. 1 for weekly, 2 for fortnightly

Can a refund be reclaimed without a PPSN? If a PPSN is made available afterwards should a correction be made so the refund can be claimed?

No. This only applies if employee was on payroll with PPSN submitted between 01/02 and 15/03 for pay date 01/02 to 15/03

If, in rare case, the new RPN instruction is for some reason resulting in a tax underpayment - is it ok for RPN be put on week 1 basis by Employer to protect the 203 payment.

Yes. It is okay for employer to put on a week 1 if payroll would lead to an underpayment of tax.

If the employee is currently PRSI Exempt should we remove that Exemption to avoid any validation conflicts on ROS when processing?

Yes remove the PRSI exemption to allow J9 be recorded.

Is there any cut off commencement date

No. Only applies if employee was on payroll with PPSN submitted between 01/02 and 15/03 for pay date 01/02 to 15/03

Should a cessation date for the employee be included in a PSR if employer is not operating this scheme and employee claims directly from DEASP when laid off?

Yes. If the employer is not operating scheme, cease the employment and the employee claims from DEASP

Could the €203 change?

Yes, it could change.

What if employee returns to work in 4 weeks or 5 weeks? Do they only get payment for this shorter period?

Yes. This only applies for the length of the temporary lay off, as opposed to 6 weeks.

Will the J9 class be reflected on subsequent RPNs issued for the employee once the J9 class has been reflected on earlier PSRs?

RK – no RPN will not be updated with J9 class

If software not ready this week, can employer simply pay the 203 and include on a late PSR next week?

Yes.

More Information

https://www.gov.ie/en/publication/612b90-covid-19-information-for-employers/

https://www.gov.ie/en/service/6c6582-employer-covid-19-refund-scheme/

https://www.revenue.ie/en/employing-people/employee-expenses/e-working-and-home-workers/index.aspx