Introduction

We recommend that people use Direct reporting. However, if you need to use ROS reporting for technical or other reasons, you can also do this with Payback.

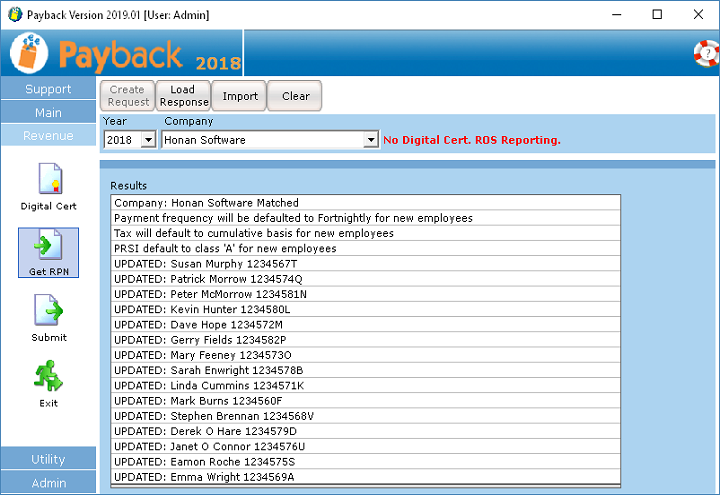

If you do not assign a digital certificate to a company then ROS reporting is used.

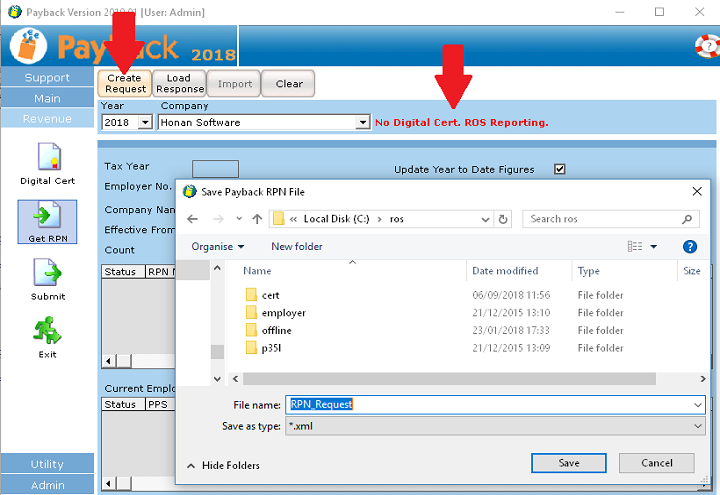

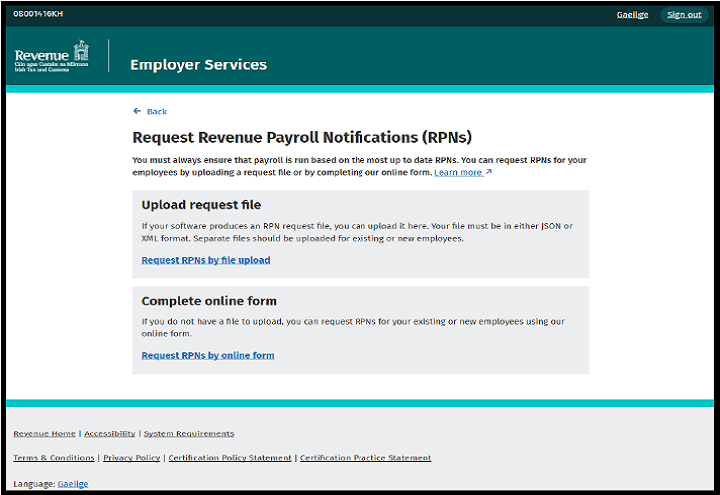

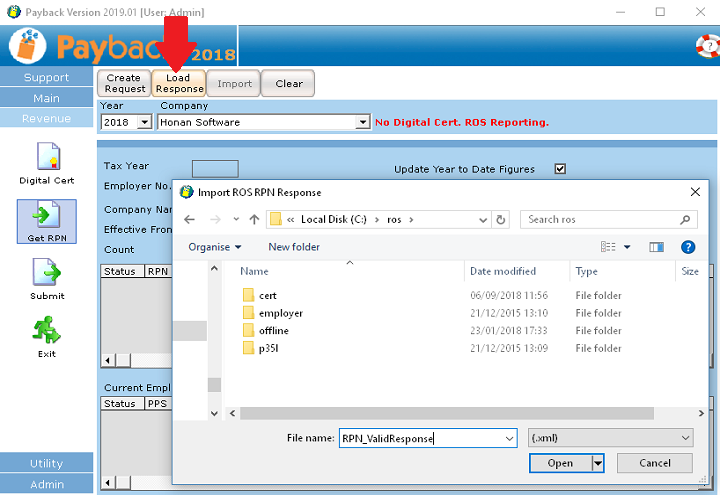

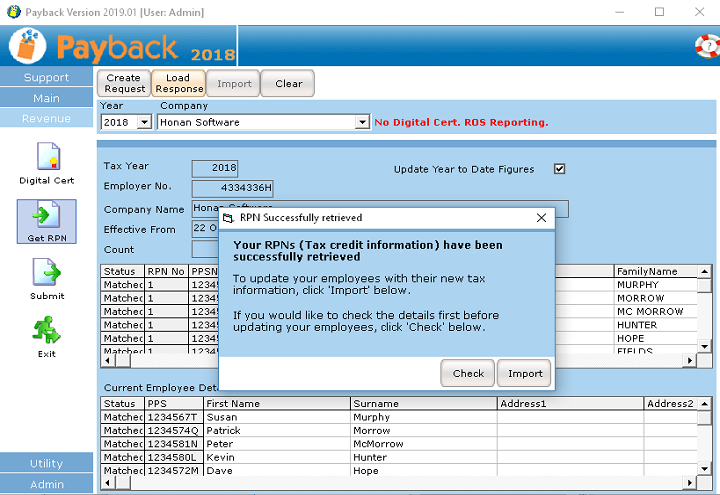

The new way to import P2C (Tax Credit) files is now using the Payback RPN (Revenue Payroll Notification) screen. Under ROS reporting, this is pretty similar to the way the old Tax Credits screen worked. The main difference is now you have to first create a ROS Request file to get your data.