Introduction

Starting 1 January 2024, employers will have to submit certain Expenses and Benefits to Revenue in the similar way payroll is submitted.

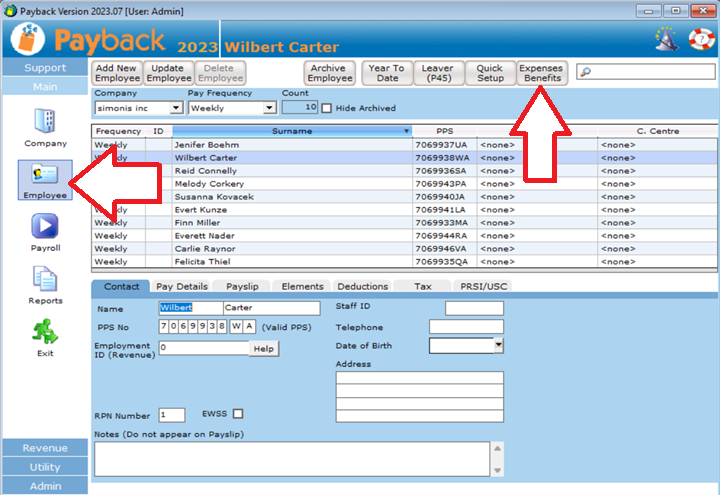

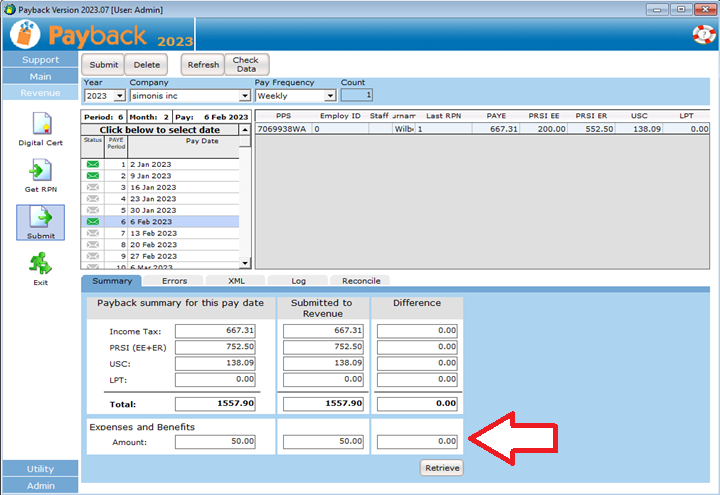

These benefit and expenses can be either submitted through Payroll or through separate expenses software. If you use separate expenses software, it is suggested that you check that the product can make these submissions to Revenue. If you opt to submit this through payroll, then Payback will automatically make the expenses submission when you submit your payroll.

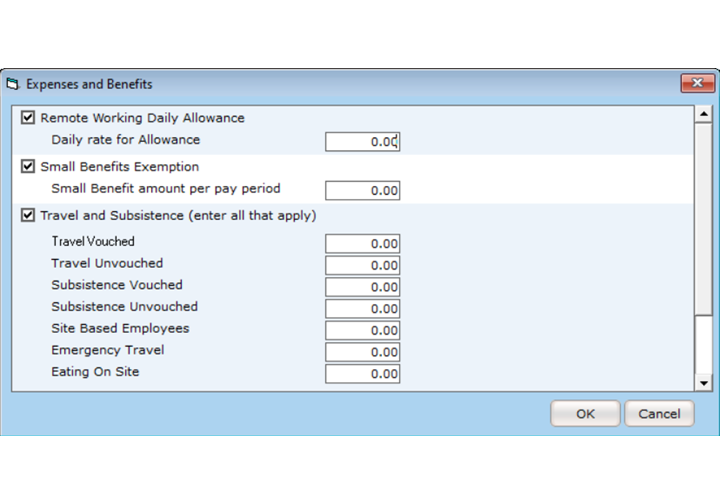

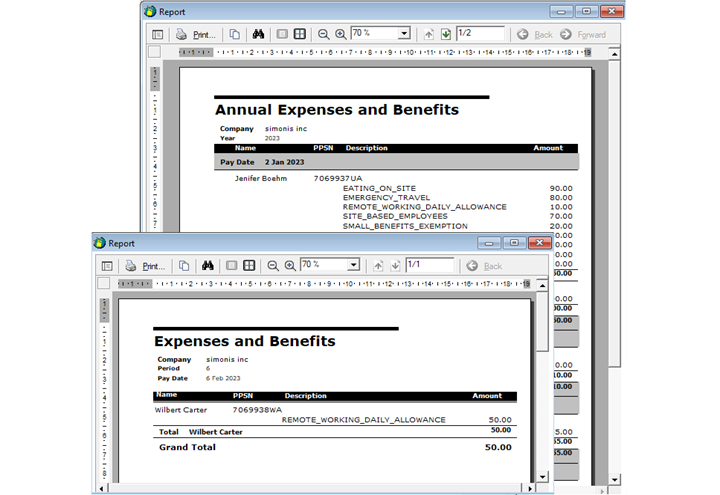

The Benefits and Expenses you need to report are:

- Travel and Subsistence

- Vouched Travel

- Unvouched Travel

- Vouched Subsistence

- Unvouched Subsistence

- Site Based Employees

- Emergency Travel

- Eating on site

- Remote Working Daily Allowance

- Small Benefits Exemption

(The Small Benefits exemption includes the annual tax exempt €1000 gift vouchers)

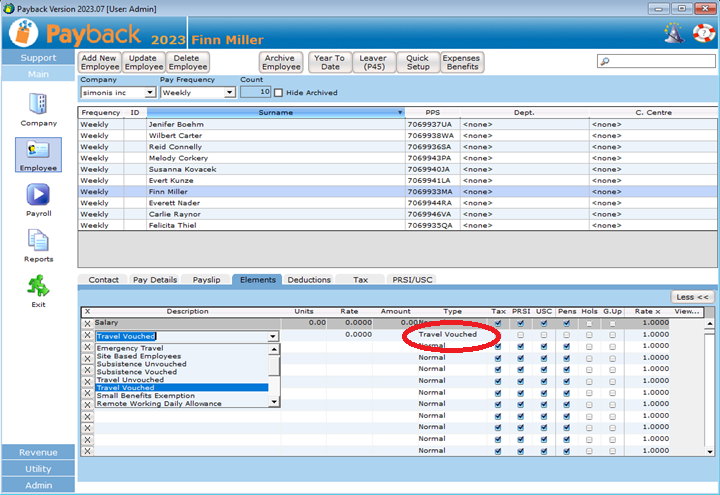

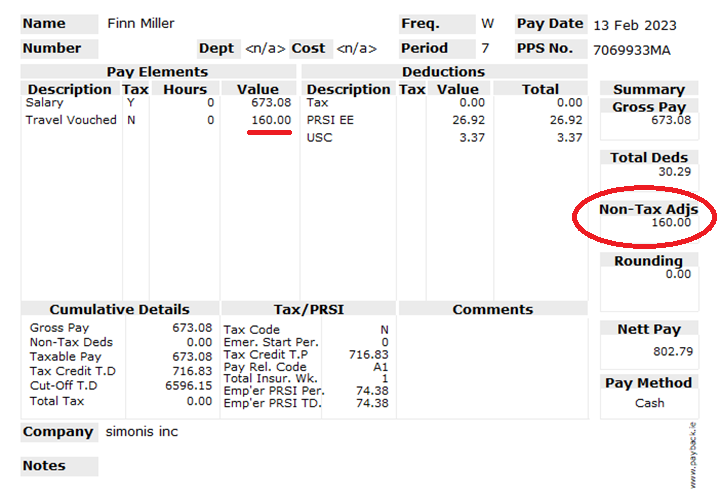

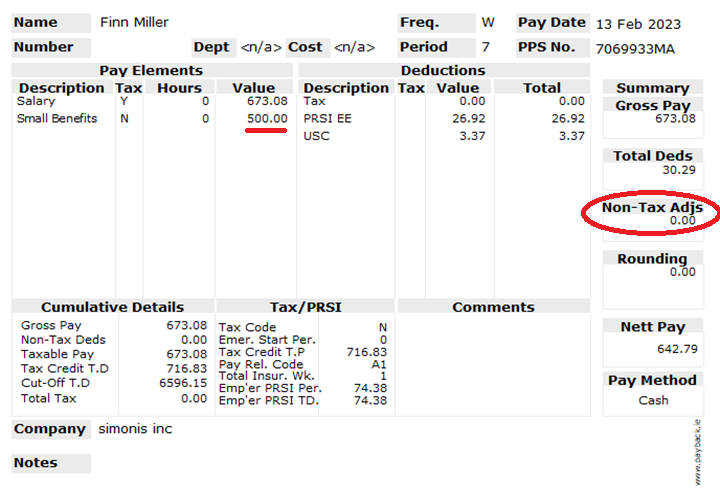

Note that if you process these through payroll, then the expense amounts will be added onto the employee's net pay.

The only Benefit is 'Small Benefits Exemption', and as this is a benefit it is not added onto net pay. This is because the employee will instead be receiving a gift voucher. It will however, still appear on the pay slip and be submitted to Revenue. It is treated like non-taxable notional pay.