Introduction

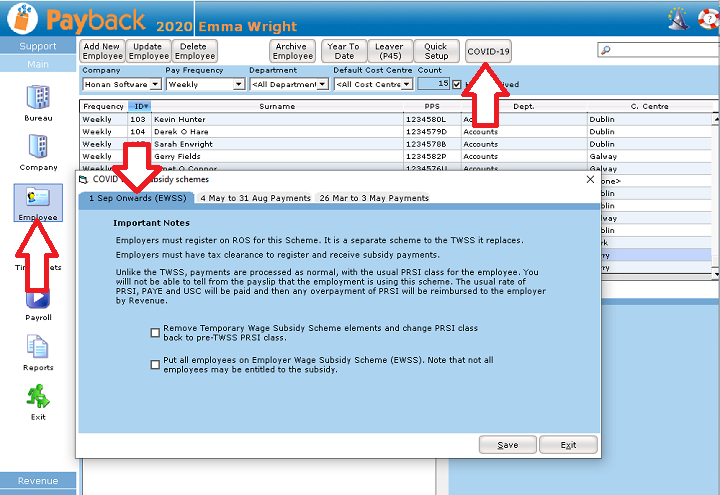

The Employment Wage Subsidy Scheme will run from 1 September 2020. Any Temporary Wage Subsidy Scheme submissions (J9) with a pay date after 31 August will be rejected by ROS.

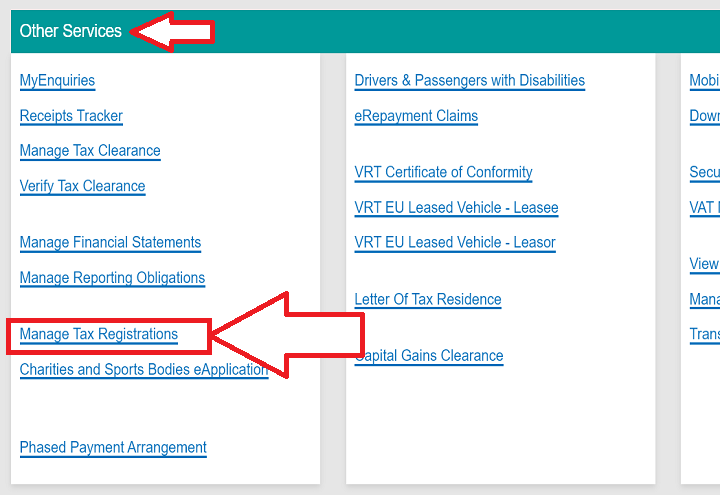

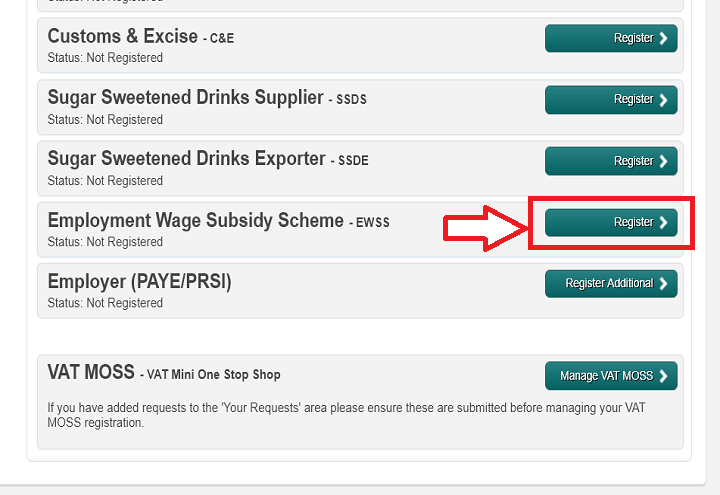

The new scheme differs significantly from the TWSS. Employers will have to Register via ROS and have a tax clearance certificate. The subsidy is paid directly to the employer at these rates per eligible employee:

Employee weekly gross pay

Less than €151.50: No subsidy payable

€151.50 to €202.99: Subsidy is €151.50

€203.00 to €1462.00: Subsidy is €203.00

More then €1462.00: No Subsidy payable

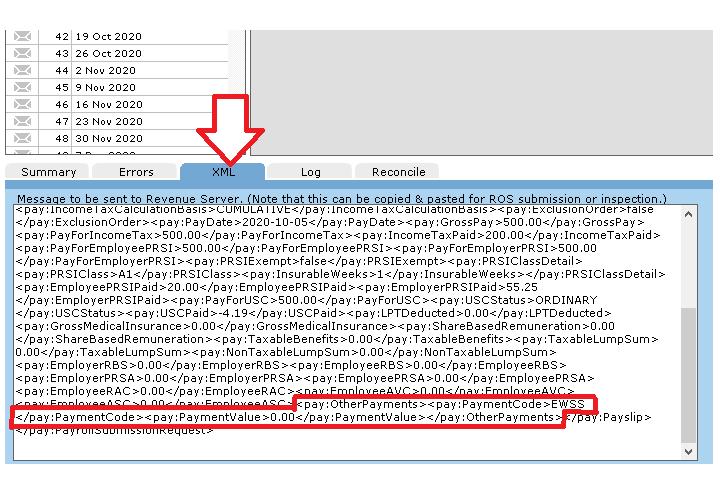

The Employer will process the payroll as usual, applying all relevant taxes and submit to Revenue. Revenue will then pay the subsidy to the employer. Nothing will appear on the Employee's payslip to indicate that the employer is in receipt of the subsidy.

Employers will no longer have to download CSV files. Revenue will automatically calculate the refund amount.

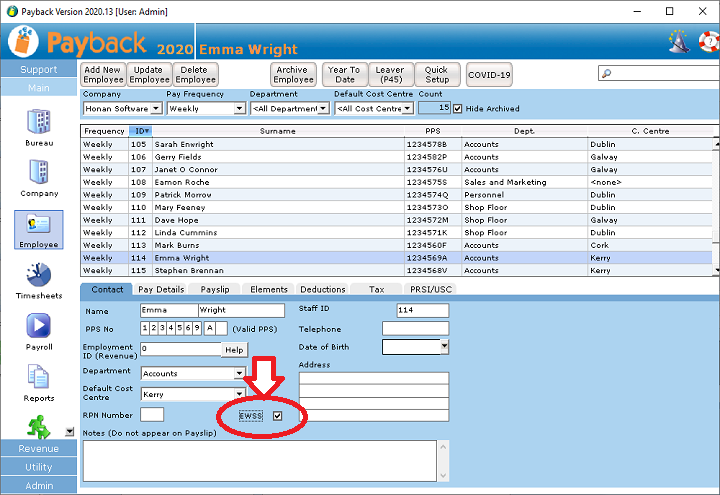

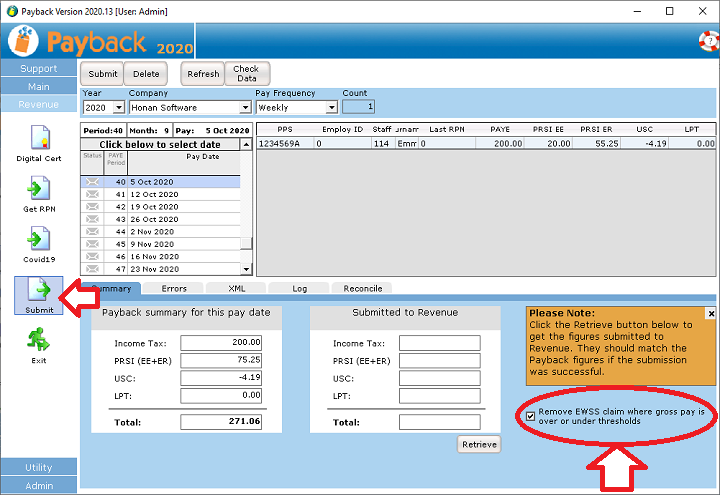

Version 2020.13 of Payback is ready to cater for this scheme, and can be downloaded from here (You must be running version 2020.13 or later to use this scheme):

https://www.payback.ie/support/downloads/

Note that EWSS submissions will not work until Revenue goes live with this scheme.