Introduction

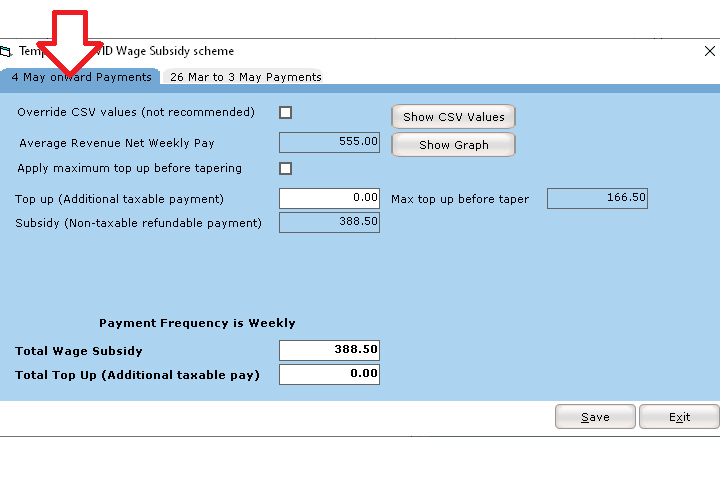

From 4 May 2020, the TWSS (Temporary Wage Subsidy Scheme) begins the Operational Phase.

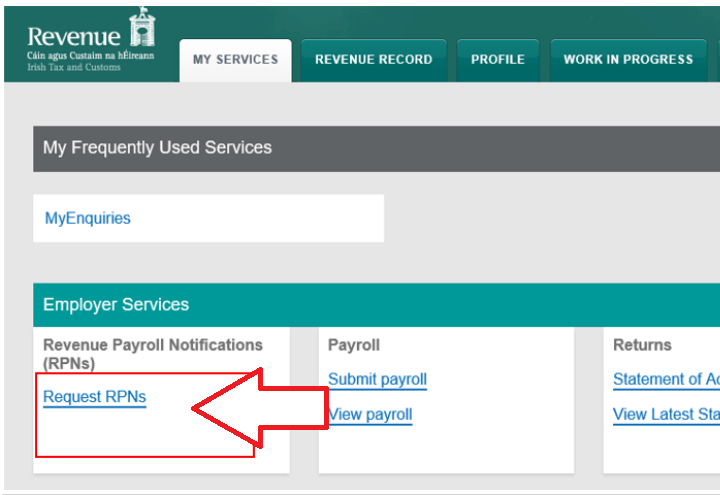

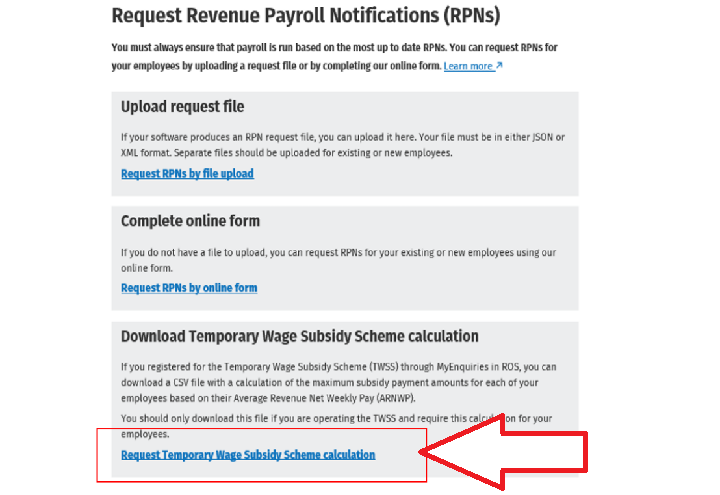

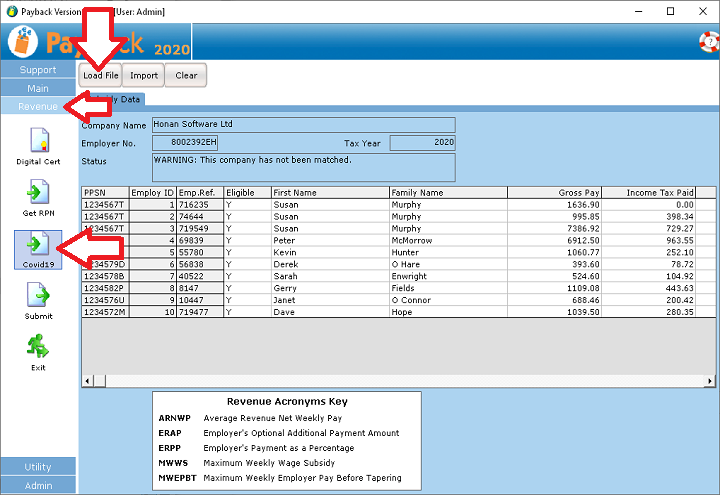

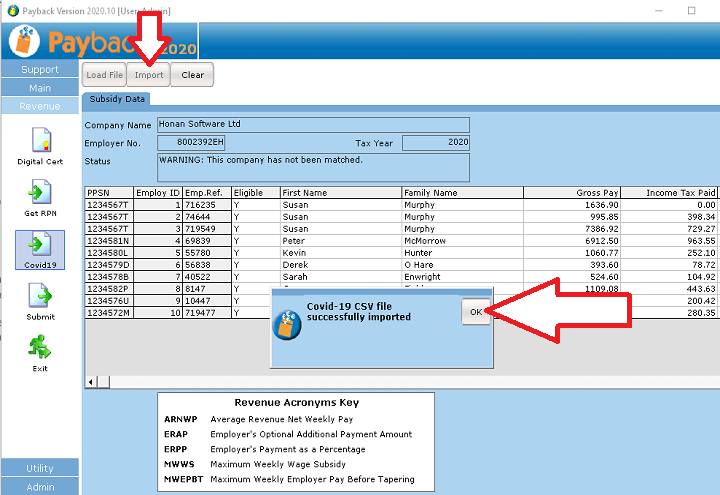

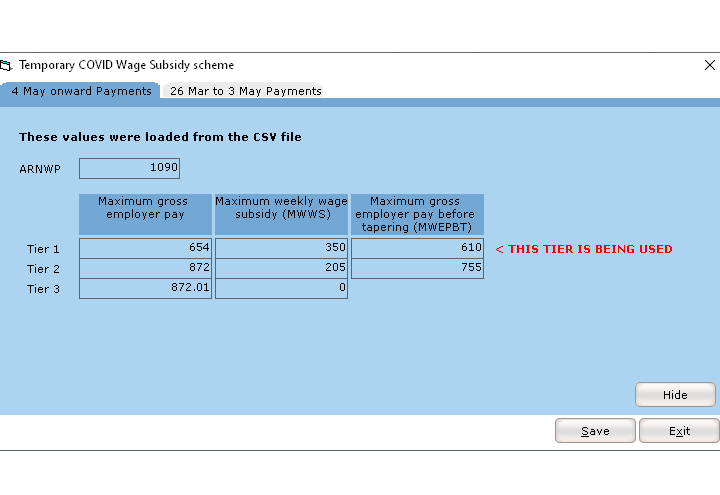

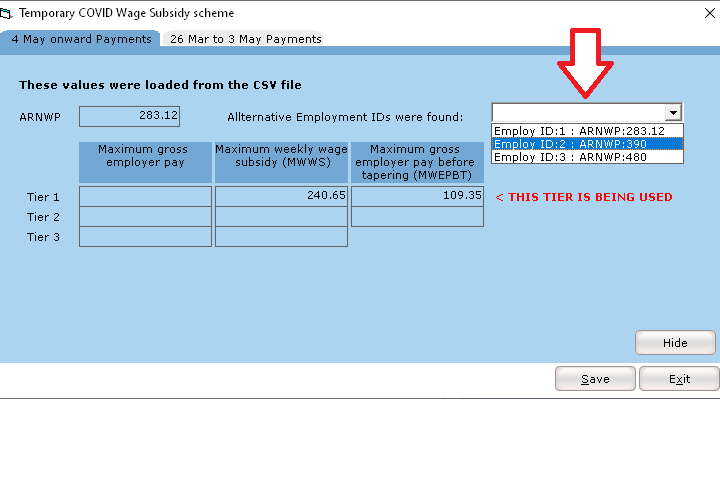

The main difference to the Transitional Phase is that Revenue now supply 'Calculation CSV' files that should be downloaded and used to calculate the subsidy and any additional payment amounts.

Revenue advise that they will refund the applicable wage subsidy having regard to the maximum wage subsidy and the level of gross pay reported by the employer for each eligible employee. At a later date, Revenue will reconcile the amount of the employer wage subsidy refunds from 26 March with the maximum wage subsidy applicable to each employee. This may involve recouping refunded amounts from employers.

Before running the operational phase, please make sure that you have upgraded to at least version 2020.10.

https://www.payback.ie/support/downloads/

Here are instruction on how to process the Operational Phase.