Introduction

This information is only for companies that operated any of the Wage Subsidy schemes, up to 31 August 2020.

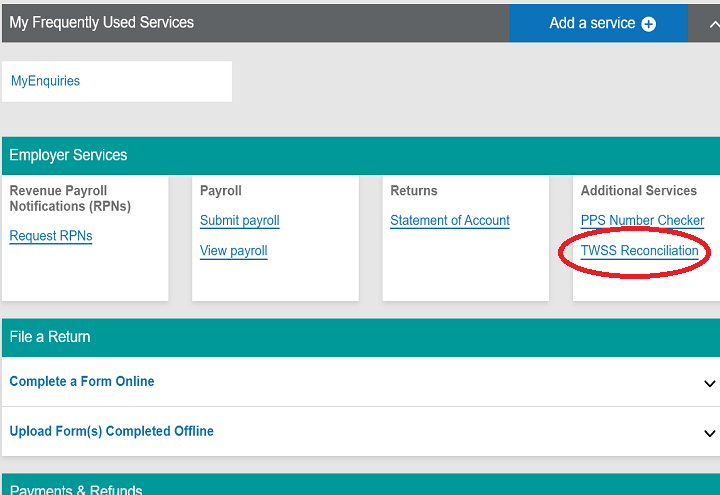

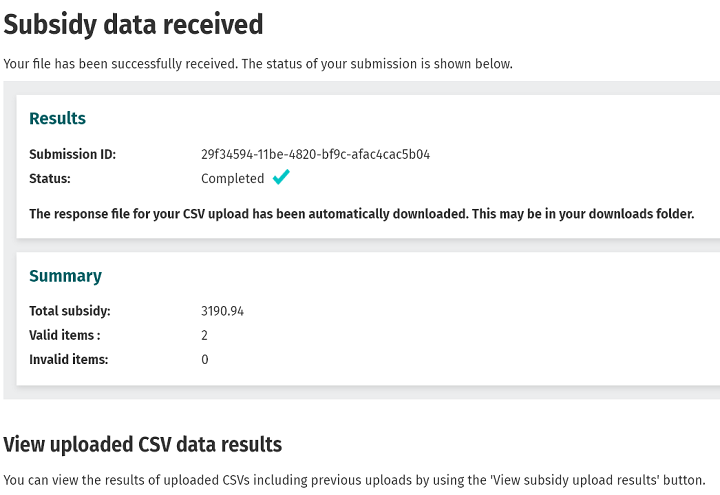

Revenue has a requirement for an accurate reconciliation between subsidy amounts refunded by Revenue to employers and the amounts of subsidy that were paid to employees by employers.

To do this reconciliation, Revenue have instructed employers to report the actual subsidy that they paid to employees on each pay date to determine whether the employer has to pay money to Revenue, or if they are due a refund.

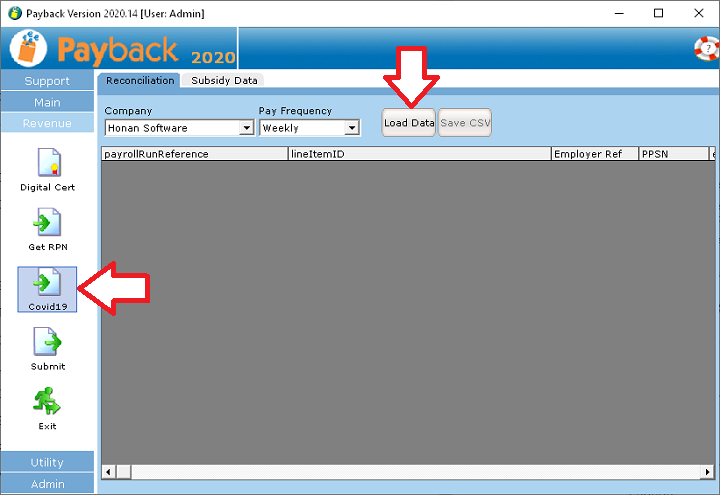

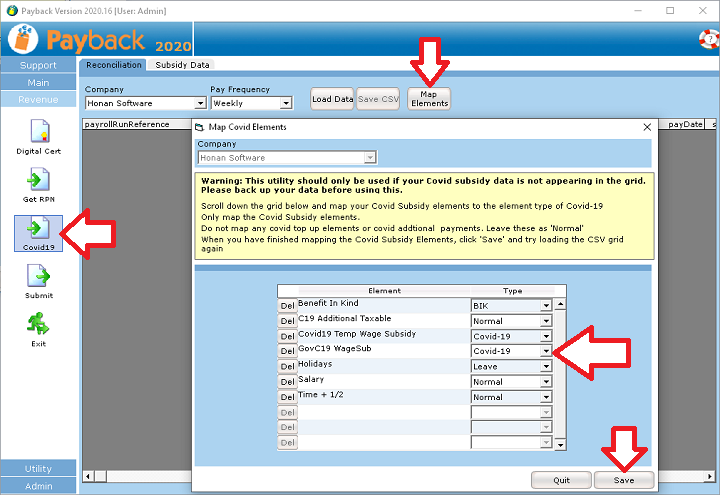

Payback uses CSV upload to do this. This appears to be the easiest way of doing this with the least impact on the submissions you've already submitted. Rather than have to re-submit everything, you'll be able to upload one file that contains all the pay dates. There is also the option to inspect and manually adjust figures before upload.

Important: We have removed this utility from the 2021 version of Payback. If you have not yet uploaded the subsidy file and have already upgraded to version 2021, please download and install this version:

https://www.cloudpay.ie/downloads/setup2020_17.exe