Introduction

A new enhanced COVID-19 scheme has been announced. More information about this scheme can be found here:

We do not recommend using the scheme unless you absolutely have to. This is because:

- It is very complex and keeps changing.

- There is going to be another major change on 4 May (was 20 April)

- Employees will be taxed on this, just not through payroll.

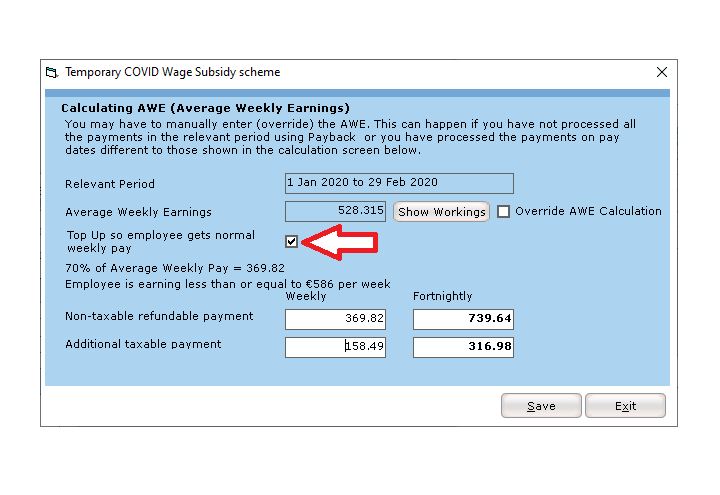

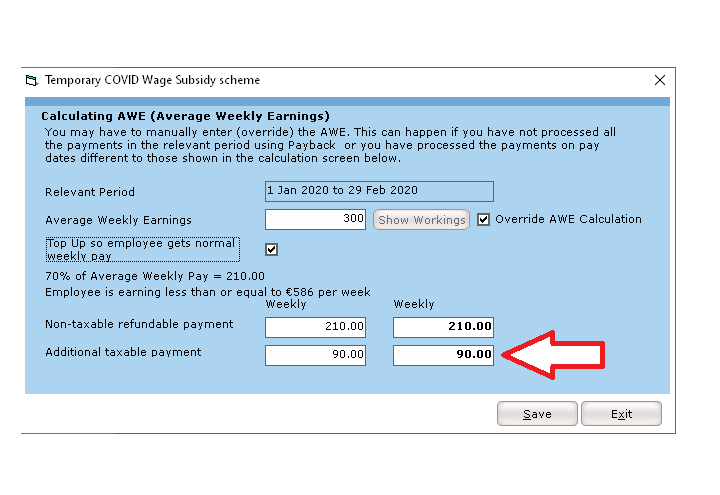

- Add too much additional payment and Revenue will reduce the subsidy. This could leave employers out of pocket.

- Employees may be better off through social welfare: https://services.mywelfare.ie/en/topics/covid-19-payments/

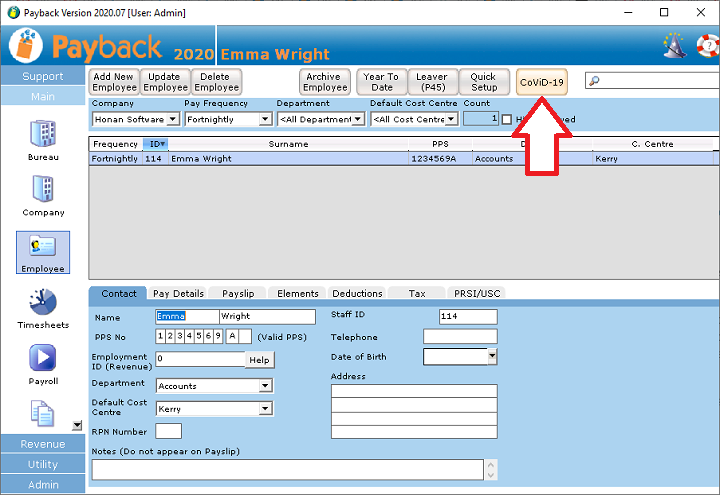

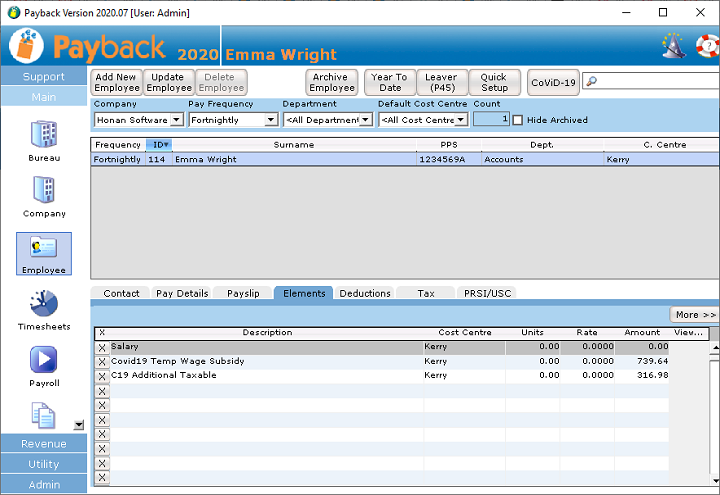

If you need to use this scheme, please make sure that you have installed at least version 2020.09 of Payback. The latest version can be downloaded from here:

https://www.payback.ie/support/downloads/

Employers adversely affected by COVID-19 can either lay off their employees or use the Temporary COVID-19 Wage subsidy scheme. This new scheme supersedes the old €203/week scheme.

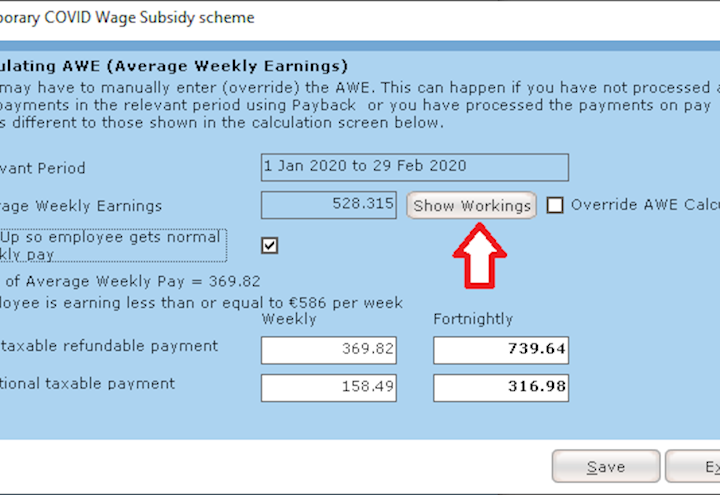

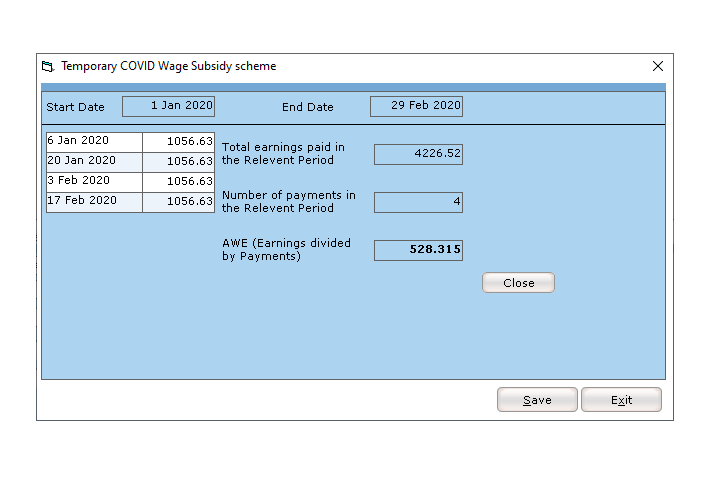

We have developed what is a rather complex new scheme, in a very short time. We are also aware that the details may change again. Due to this, we have tried to make the implementation as flexible as possible. This means that the figures can be over-ridden. If needs be, the scheme can be set up manually by directly entering the elements.

Please note: We have had very little time to test this!