Introduction

The TWSS subsidy was treated for tax like a social welfare payment. This meant that it was not taxed through payroll, like salary is.

This means that many employees may now owe tax incurred through TWSS.

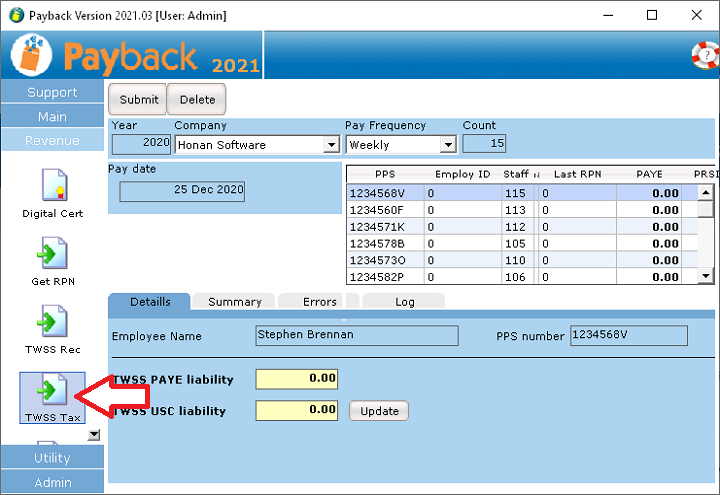

Revenue have advised us that to pay this subsidy, employers should submit a payroll submission for a pay date of 25 Dec 2020, so that it falls in the 2020 tax year. 25 Dec 2020 was chosen as not many submissions go through for that pay date.

The employee is liable for both PAYE and USC, so the following two fields should be filled:

- IncomeTaxPaid

- USCPaid

Everything else should be left blank. This utility will allow you to submit a PSR with these values filled.

Revenue are permitting these amounts to be paid without incurring benefit in kind.

The deadline for this is 30 Sep 2021.

Paying this is optional for Employers. More information can be found here:

https://www.revenue.ie/en/tax-professionals/ebrief/2021/no-0972021.aspx