Introduction

Cloudpay calculations are tested and checked every time the Government makes statutory changes that affect them, such as Budget changes.

The figures are tested against the desktop version, a competitor product and also manually.

How to check Cloudpay calculations

Cloudpay has a facility that allows the user to see how PAYE, PRSI and USC were calculated for the currently selected payment.

To access this, select the payment and click the 'Calculation' button at the top of the Payroll screen.

Calculating PAYE

There are two ways PAYE (income tax) can be calculated, either Cumulative or Week/Month one basis. The usual. most common way of calculating PAYE is cumulatively. In Cloudpay cumulative basis is also called 'Normal' basis.

How Cloudpay calculates cumulative PAYE

For payments calculated on a cumulative basis, the tax paid and taxable pay are both added up from all previous payments, to calculate the liability. This means that what the employee has previously earned and the tax they have previously paid will impact the current payment.

To calculate the payment, we need:

- Standard rate cut off point (SRCOP)

- Tax credits

- All taxable pay to date

- All PAYE paid to date

The standard rate cut off point is the value at which the employee starts paying the higher rate of PAYE. Tax credits is money that can be taken off to reduce the final liability.

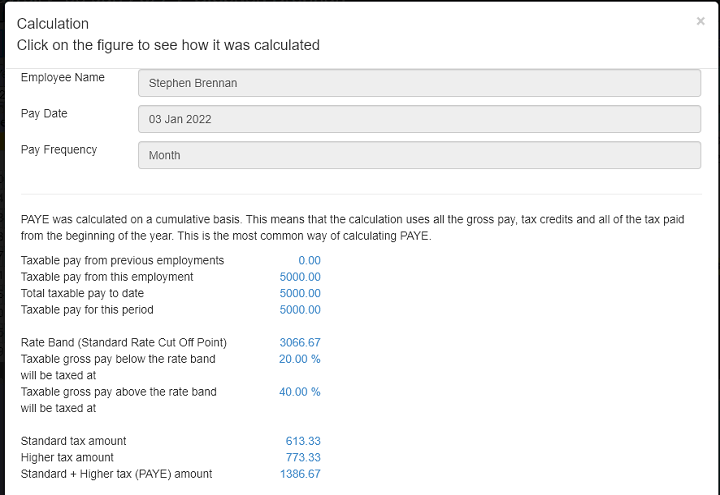

Example One - Monthly paid employee. January payment.

lower tax rate: 20%

Higher tax rate: 40%

Annual SRCOP: 36800.00

Annual Tax Credits: 3400.00

Monthly Pay: 5000.00

The PAYEable amount below the SCROP should be taxed at the lower tax rate:

Month SRCOP = (36800.00 / 12) = 3066.67

First month SRCOP = 3066.67

20% portion of pay (lower tax rate) = 3066.67

Lower rate tax amount = (3066.67 / 100) x 20 = 613.34

The PAYEable amount above the SCROP should be taxed at the higher tax rate:

40% portion of pay (higher tax rate) = 5000.00 - 3066.67 = 1933.33

Higher rate tax amount = (1933.33 / 100) x 40 = 773.33

Total PAYE = 613.34 + 773.33 = 1386.66

Deduct the tax credits for this month

Month Tax Credits = (3400 / 12) = 283.33

First month Tax Credits = 283.33

Grand total PAYE Liability = (1386.66 - 283.33) = 1103.33

Example Two - Monthly paid employee. February payment.

lower tax rate: 20%

Higher tax rate: 40%

Annual SRCOP: 36800.00

Annual Tax Credits: 3400.00

Monthly Pay: 5000.00

Taxable pay to date (January Pay): 5000.00

This period taxable pay = 5000.00 + 5000.00 = 10000.00

Tax paid to date = 1103.33 (January PAYE amount)

The PAYEable amount below the SCROP should be taxed at the lower tax rate:

Month SRCOP = (36800.00 / 12) = 3066.67

Second month SRCOP = 3066.67 x 2 = 6133.33

20% portion of pay (lower tax rate) = 6133.33

Lower rate tax amount = (6133.33 / 100) x 20 = 1226.67

The PAYEable amount above the SCROP should be taxed at the higher tax rate:

40% portion of pay (higher tax rate) = 10000.00 - 6133.33 = 3866.67

Higher rate tax amount = (3866.67 / 100) x 40 = 1546.67

Total PAYE = 1226.67 + 1546.67 = 2773.33

Deduct the tax credits for this month

Month Tax Credits = (3400 / 12) = 283.33

Second month Tax Credits = 283.33 x 2 = 566.67

Total PAYE Liability = (2773.33 - 566.67) = 2206.67

Deduct tax paid to date (January tax) = (2206.67 - 1103.33) = 1103.33

Grand total PAYE Liability = 1103.33

How Cloudpay calculates week/month one PAYE

For week/month one PAYE, only the current payment is taken into consideration. Any figures from previous payments, such as taxable pay or tax paid, are not used. Any old employment figures are not used either.

Example Three - Monthly paid employee. February payment.

lower tax rate: 20%

Higher tax rate: 40%

Annual SRCOP: 36800.00

Annual Tax Credits: 3400.00

Monthly Pay: 5000.00

The PAYEable amount below the SCROP should be taxed at the lower tax rate:

Month SRCOP = (36800.00 / 12) = 3066.67

Monthy SRCOP = 3066.67

20% portion of pay (lower tax rate) = 3066.67

Lower rate tax amount = (3066.67 / 100) x 20 = 613.34

The PAYEable amount above the SCROP should be taxed at the higher tax rate:

40% portion of pay (higher tax rate) = 5000.00 - 3066.67 = 1933.33

Lower rate tax amount = (1933.33 / 100) x 40 = 773.33

Total PAYE = 613.34 + 773.33 = 1386.66

Deduct the tax credits for this month

Month Tax Credits = (3400 / 12) = 283.33

Monthy Tax Credits = 283.33

Grand total PAYE Liability = (1386.66 - 283.33) = 1103.33

Calculating PRSI

Unlike PAYE, PRSI is always calculated on a Week/Month one basis. This means that the previous payment figures are not taken into consideration.

PRSI has two components, Employee PRSI and Employer PRSI. This means that the as well as the Employee paying PRSI, the Employer also contributes a PRSI amount.

To Calculate PRSI you will need:

- PRSI Class of employee

- Pay amount liable for PRSI

Example one - PRSI Class A, with €1736.00 monthly pay liable for PRSI.

Calculate Employee Amount.

PRSI is based on insurable weeks, so we need to 'convert' from months to weeks. This is done by the divisor of (52/12)

Weekly pay liable for PRSI = 1736 / (52 / 12) = 400.62

Look up the SW14 for the PRSI class A and liable pay of 400.62:

https://www.gov.ie/en/collection/06bf07-prsi-contribution-rates-and-user-guide-sw14/

(Note that this bands can change every year)

For 2022, this is class AX because 400.62 falls in the €352.01 to €410 band.

For sub-class AX, Employee percent = 4.00% and Employer percent = 8.80%

4% of 1736.00 = 69.44

Calculate the PRSI credit

As this is sub-class AX, a PRSI credit applies. Since 2016 for subclasses, AX, AL, A9 and HX there is a weekly credit of €12.

The credit is a weekly amount so we need to multiply this to get a monthly amount. To find the multiplier:

Daily = (1 / 7)

Annual = (Daily x 365)

Monthly = (Annual / 12)

Multiplier = ((1/7) x 365) / 12 = about 4.35

The Credit should only apply to the portion of the Pay liable to PRSI that falls within the sub-class band (352 to 424)

Find the amount that falls within the band.

Monthly Credit = Weekly Credit x Multiplier

Monthly Credit = 12 x 4.35 = 52.14

Sub-class Min creditable = Weekly Min Creditable x Multiplier

Sub-class Min creditable = 352 x 4.35 = 1529.52

Sub-class Max creditable = Weekly Min Creditable x Multiplier

Sub-class Max creditable = 424 x 4.35 = 1842.38

Amount of Pay liable to PRSI within the band = 1736.00 - 1529.52 = 206.48

Now we apply the credit

Credit Devisor = (Sub-class Max creditable - Sub-class Min creditable) / Weekly Credit

Credit Devisor = ( 424 - 352 ) / 12 = 6

Applicable Credit = Monthly Credit - (Amount of Pay liable to PRSI within the band / Credit Devisor)

Applicable Credit = 52.14 - (206.48 / 6) = 17.73

Total Employee PRSI = 69.44 - 17.73 = 51.71

Calculate Employer Amount.

For sub-class AX, Employer percent = 8.80%

8.80% of 1736.00 = 152.77

USC

The employee is legally entitled to the tax refund under the PAYE taxation system. The tax refund will be taken from the total tax liability of the company, so the company isn't really refunding the tax, it is in effect coming from Revenue.

To make the net pay zero, you would have to process the payment using week one basis of taxation. You can change this in the PAYE tab in the Employee screen. However, we would not recommend this course of action.