Introduction

From 6 Jan 2014 Illness Benefit payment will not be made for the first six days of illness (up from three days). This means that a person will not be entitled to Illness Benefit for the first six days of their claim (unless the person was receiving Illness Benefit, Injury Benefit or a jobseekers' payment immediately before their claim). Claims with a commencement date before 6 Jan 2014 and those coming from Maternity Benefit will not be paid for the first three days of illness.

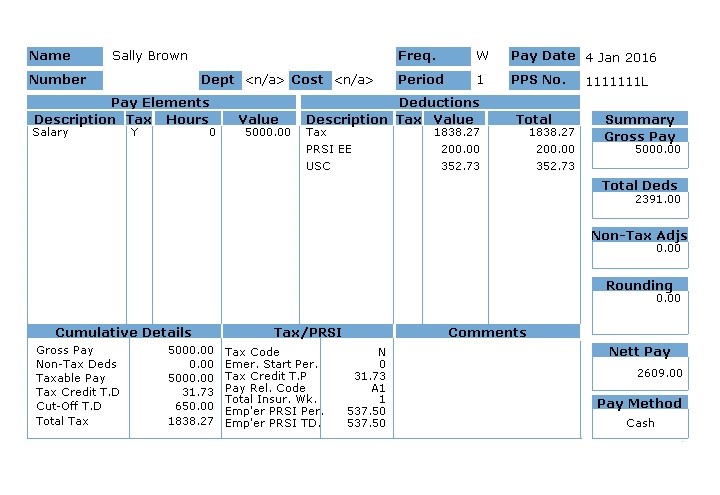

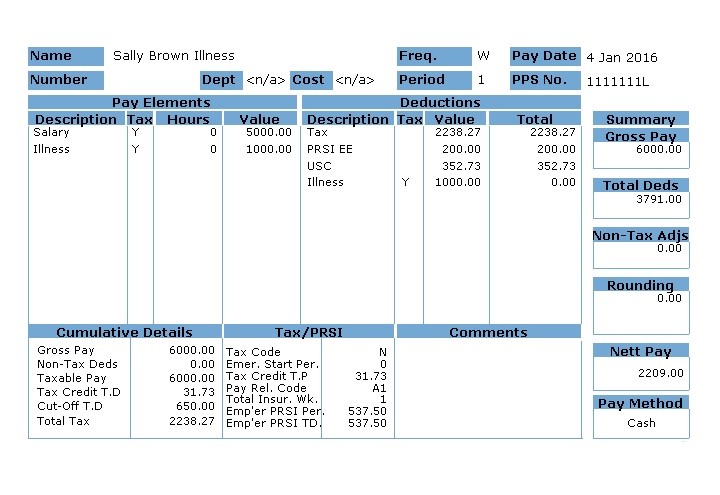

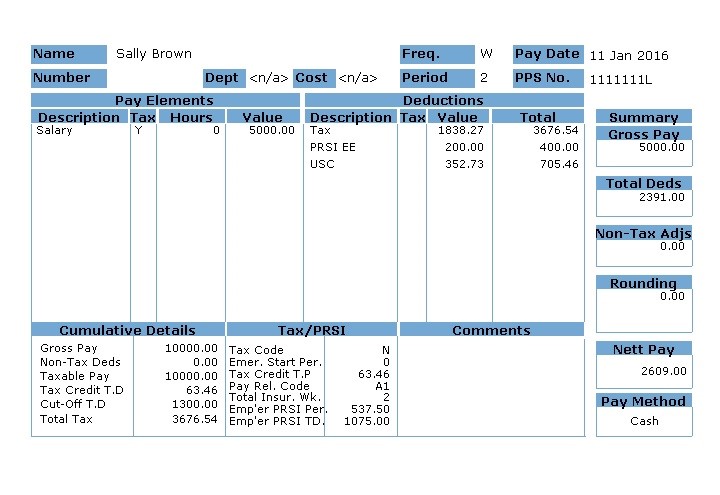

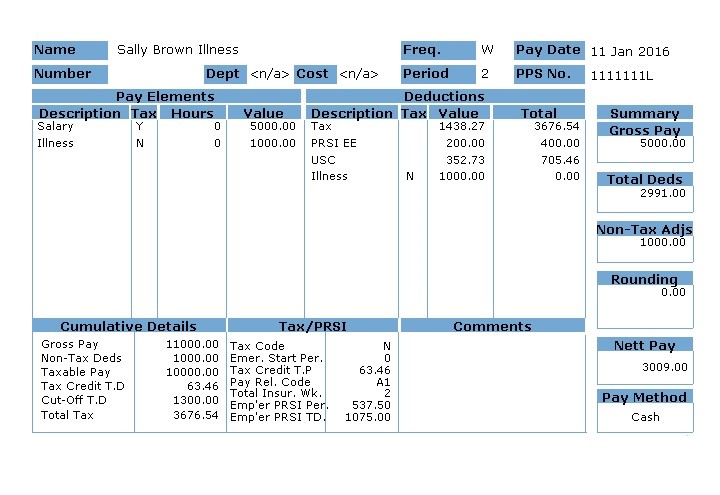

Illness Benefit is taxable. However, it is paid to the employee without any deduction of income tax. This is why Illness Benefit is put through the payroll - so that it can be correctly taxed.

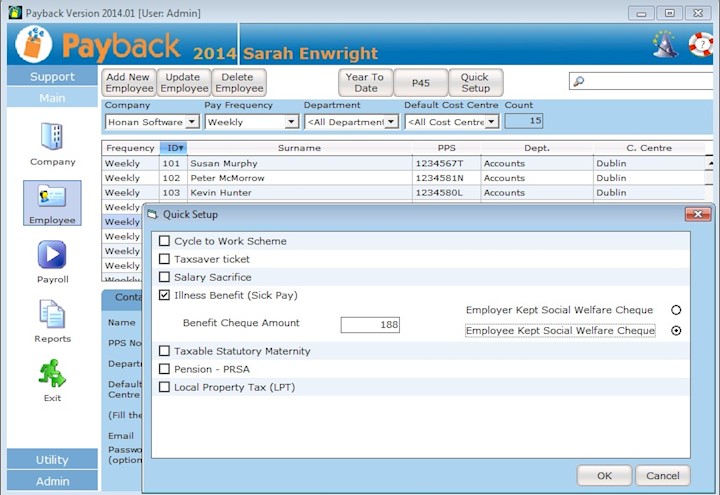

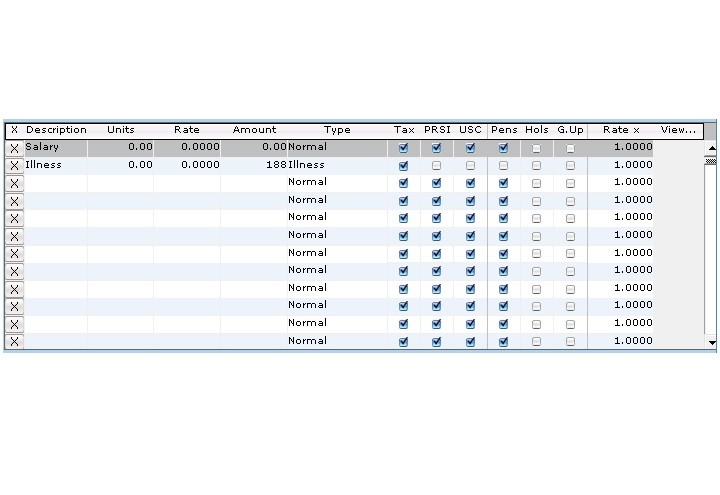

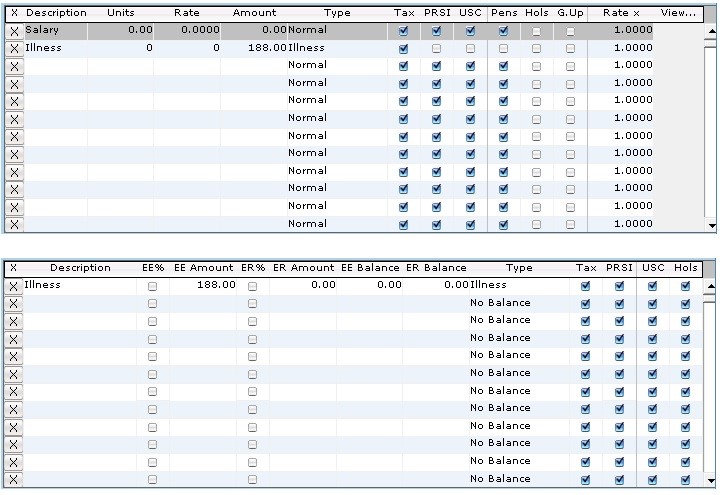

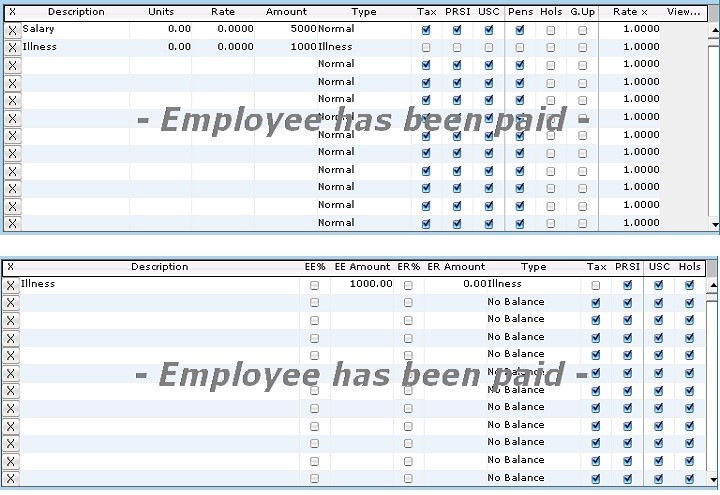

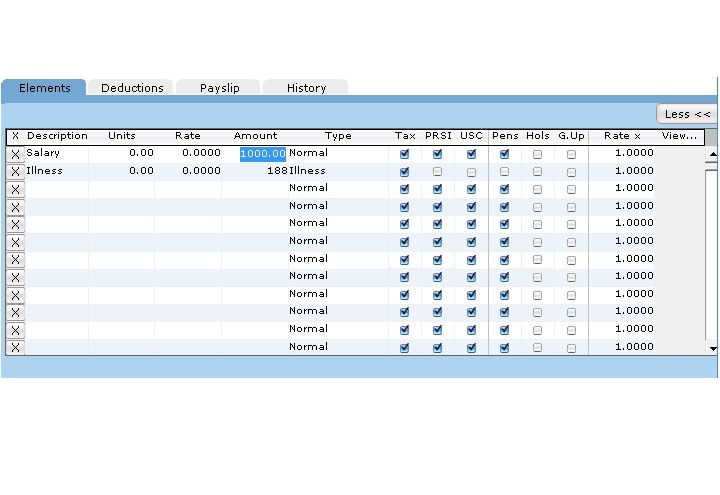

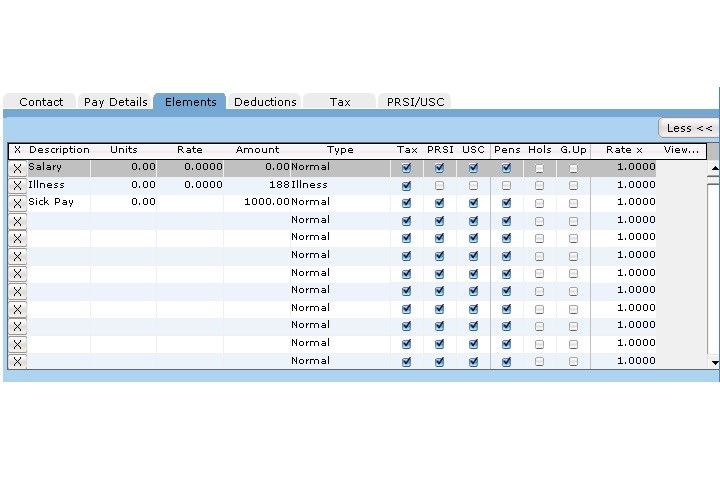

There are two ways to set up Illness Benefit in Payback, either Quick Setup facility or Manually entering elements and deductions