Maternity Pay

From the 1 July 2013, Statutory Maternity Benefit payable by the Department of Social Protection (DSP) will become taxable. USC and PRSI, however, will not apply.

Adoptive Benefit and Health & Safety Benefit, payable by the Department of Social Protection (DSP) from 1 July 2013 should be treated the same way as Maternity Benefit. (Use the same instructions to set these up, but overwrite the description column in the elements and deduction grids to suit)

Tax will be collected on these benefits by annual tax credits and cut-off point being reduced. Employers will be notified of this reduction by a ROS P2C file or a certificate of tax credits. The Maternity pay element in Payback should have tax, USC and PRSI tick boxes unticked. The Tax column is unticked because the tax credits and cut off point has been reduced instead, and the USC and PRSI columns are unticked because these do not apply.

To set up Maternity:

-

Change the tax credits by either importing a P2C file, or by using a Tax Credit certificate

-

Set up the Statutory Maternity Element

-

Add any Employer contribution (if relevent)

How to import a P2C file into Payback to change Maternity tax credits

Step 1: Retrieve the P2C file:

-

Using your internet browser, Log into ROS https://www.ros.ie/login.jsp

-

Click on the ROS box icon. Your inbox screen will appear.

-

Select the 'View PAYE P2C Details' option.

-

Make sure your tax registration number is filled, and you have selected a Tax Year.

-

Click 'View All'. A new screen will appear displaying the tax credits for your employees.

-

Click 'Export Complete List'

-

A box will appear asking about marking the P2Cs as exported - click OK

-

If asked to 'Save' or 'Open' the file, select 'Save'

-

Choose somewhere you'll be able to find the file, like on your desktop, to save it too.

-

Click 'Close' and exit your browser.

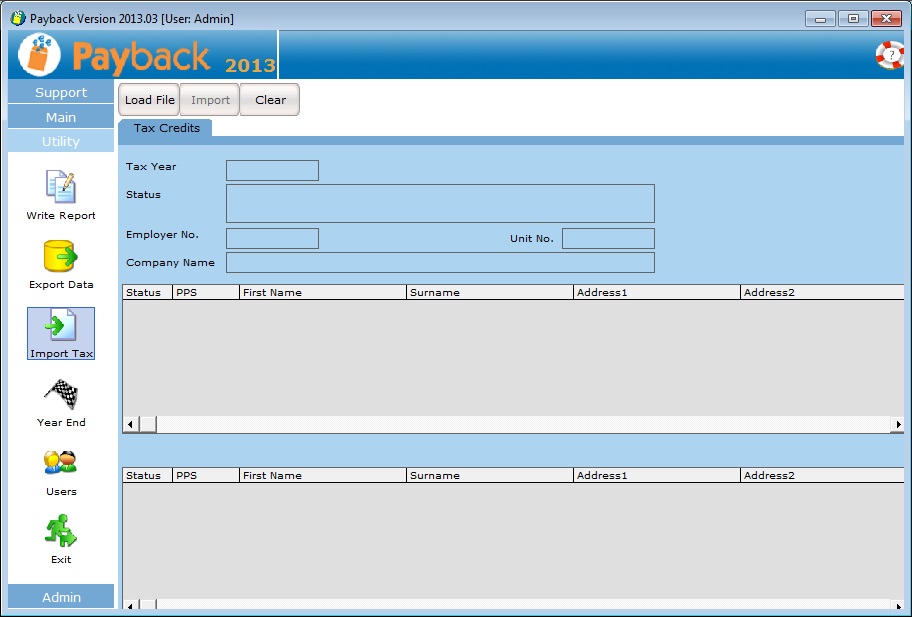

Step 2: Open Payback and click on 'Utility' on the menu at the left, and then select the 'Import Tax' icon. The P2C file import screen will appear.

Step 3: Click 'Load File' at the top of the screen and select the P2C file you downloaded from ROS in step 1. Check the data in the grids, and if you are happy, click the 'Import' button. Make sure that the company has been successfully matched before importing the data.

NOTE: Payback matches P2C data using:

- Employer No. (Details tab in Company Screen)

- PPS No. (Contact tab in Employee Screen)

Please make sure that you have entered these correctly before importing P2C files. If you have not entered an employer number for your existing companies, or have entered it incorrectly, then Payback will not be able to match up your data. If you continue with the P2C import, then a duplicate company will be created. If you have not entered PPSNs for any of your employees, or they are incorrect, then (like company, above) Payback will not be able to match the employees up to the P2C data. If you continue with the import then duplicate employees will be set up. If you find that duplicate employees have been set up, these can be deleted by following these instructions:http://www.payback.ie/phpBB3/viewtopic.php?f=6&t=3

Duplicate companies can be deleted following these instructions: http://www.payback.ie/phpBB3/viewtopic.php?f=6&t=420

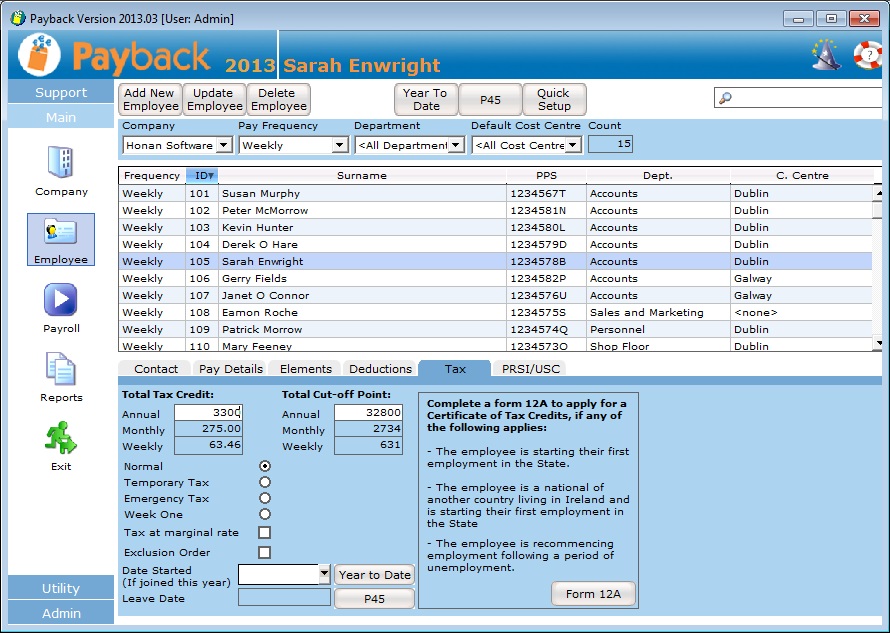

How to manually change tax credits for Maternity

Step 1: Go to the employee screen and select the employee you wish to change the Tax Credits and Cut off point for

Step 2: Click the 'Tax' Tab and make the changes. Click 'Update' Employee when you are finished.

Setting up the Statutory Maternity Element

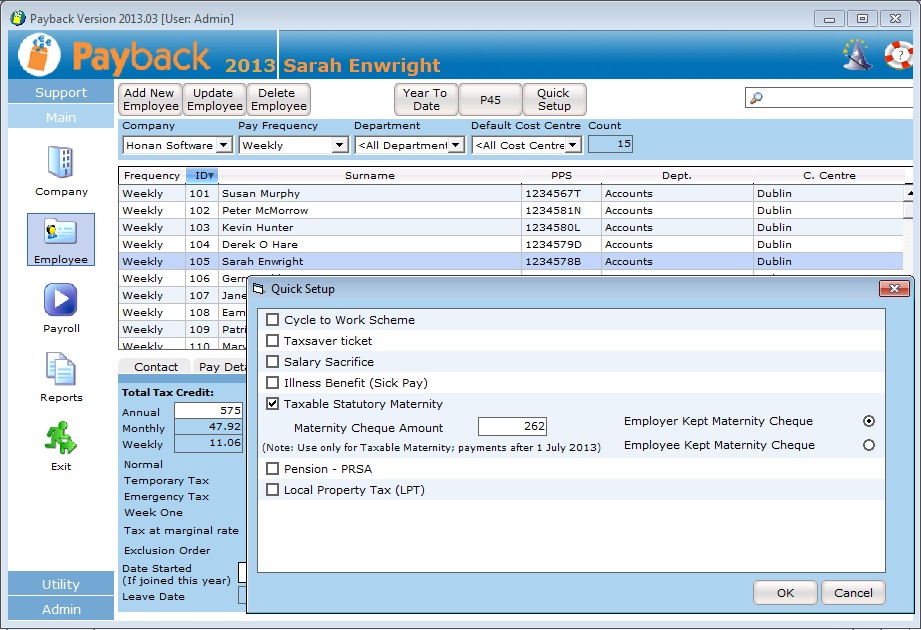

Using Quick Setup

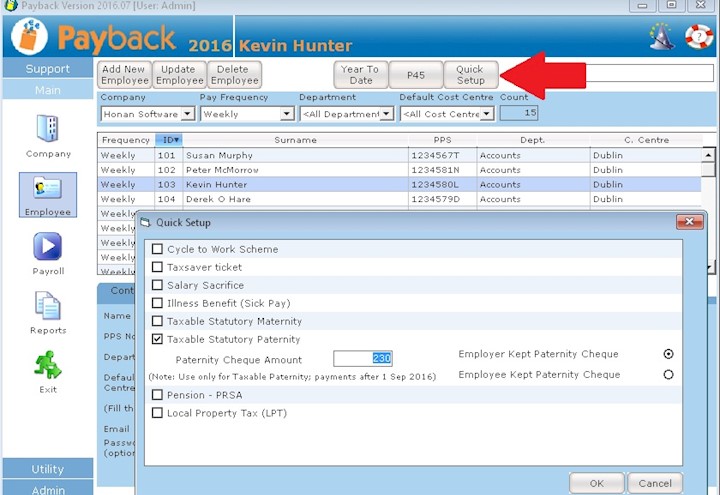

Step 1: Go to the employee screen and select the employee you wish to set up Maternity Benefit for.

Step 2: Click the 'Quick Setup' button at the top of the screen and tick the 'Statutory Taxable Maternity' tick box in the Quick Setup screen.

Step 3: Enter the amount of Maternity Benefit received each payment period from the Department of Social Protection. If the employee gives the payment to the company then tick the 'Employer Kept Maternity Cheque', otherwise select 'Employee Kept Maternity Cheque'

Step 4: Click 'OK' and then click 'Update Employee'

Entering Maternity Benefit directly into the Elements grid

Step 1: Go to the employee screen and select the employee you wish to set up Maternity Benefit for.

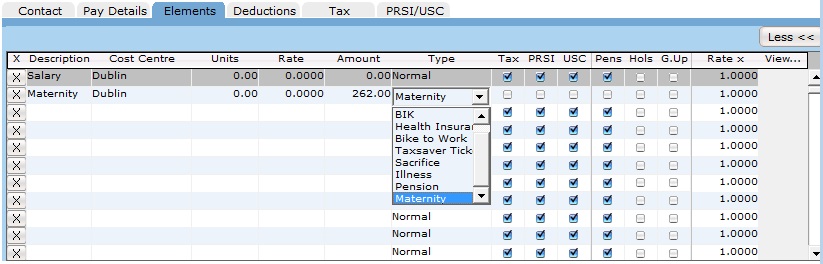

Step 2: Click the Elements tab and click on the first blank row.

Step 3: Enter 'Maternity Benefit' (or suitable description)

Step 4: Click 'More>>' at the top right of the grid. More columns will appear. Under the 'Type' column, select 'Maternity'. Put the amount of benefit per pay period in the amount column.

Step 5: Click Update employee. The elements grid should look like below:

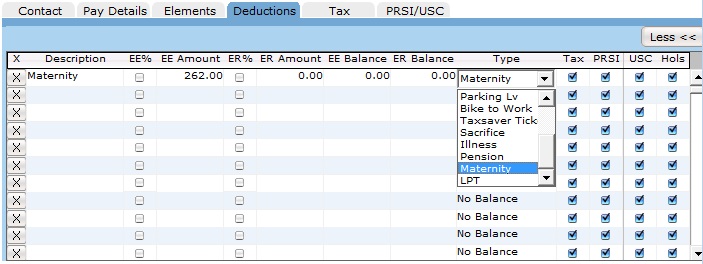

Step 6: If the employee kept the benefit payment, then add this deduction (With type 'Maternity' and the same amount as the element)

Employer tops up the Maternity Benefit with an extra amount

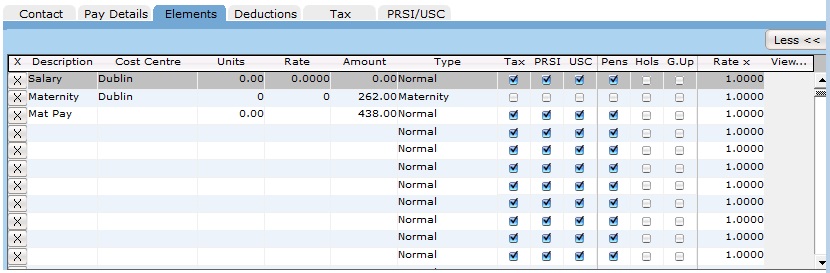

If the employer is paying extra Maternity pay, then add this extra element in the employee screen. It should look like this:

Notes

Maternity Benefit should only be taxed for pay dates on or after 1 July 2013. On pay dates before 1 July 2013, the Maternity Benefit is not taxable.

The way this benefit is taxed may result in some unusual, but correct, payslips. For example:

-

Net pay being higher than gross pay

-

No Tax, USC or PRSI being paid (This is most likely where the employee only received Maternity Benefit with no top up amount)

Maternity Benefit is not included as gross pay. It will not be added to P45, P35 or P60 figures.

Any extra 'Top Up' amount paid by the employer is fully taxable and liable to USC and PRSI.

More information about Maternity Benefit can be found here: http://www.revenue.ie/en/personal/faqs/taxation-welfare-benefits.html