If you re-used the old record for the employee, and the payments are now incorrect (over taxed) you can either re-process all the old payments so they are correct, or just reprocess the next payment for cumulatively paid employee. Follow these instructions:

- Back up your database.

- If you paid the employee then take a copy of the incorrect payslips.

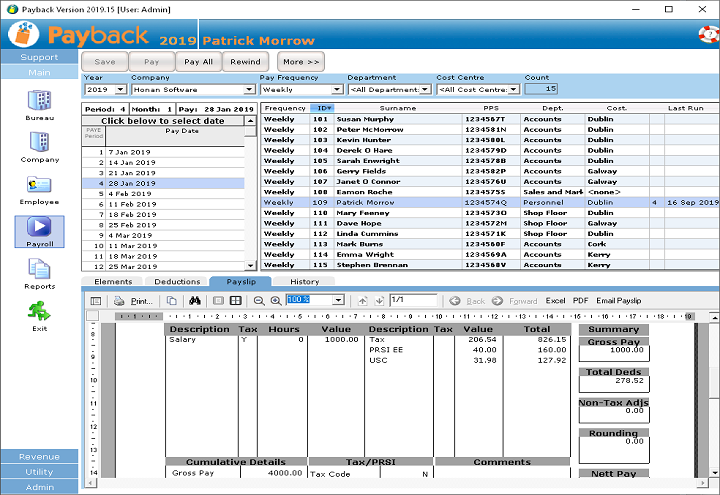

- Rewind the incorrect payments

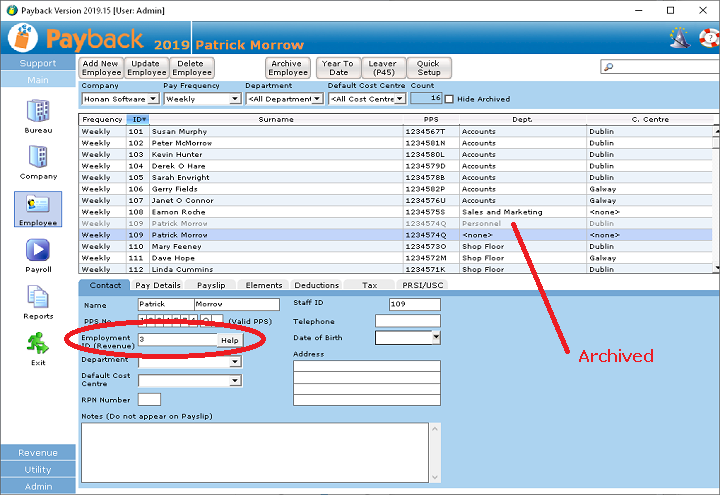

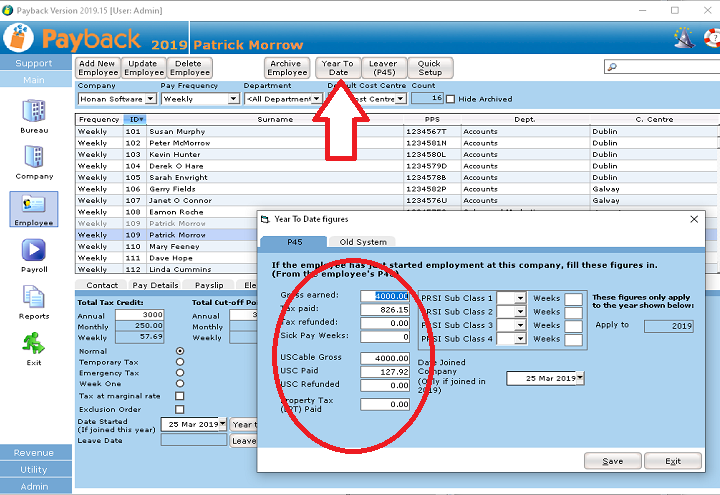

- Set up a new record for the employee as described above. If you already have a new RPN with the year to date figures in it, use the corresponding employment ID. Otherwise request a new RPN for the employee using a new employment ID

- Archive the old employee record

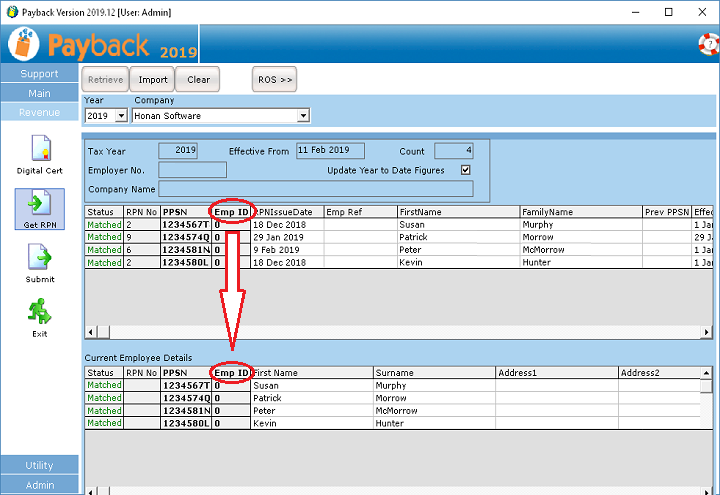

- Retrieve and update the RPNs

- re-process the payments from the new start date (skipping all the dates from the beginning of the year)

- Submit the new payments to Revenue in the submission screen.

- Pay the employee the difference and re-issue the revised payslips.

Alternatively

- Back up your database.

- Set up a new record for the employee as described above. If you already have a new RPN with the year to date figures in it, use the corresponding employment ID. Otherwise request a new RPN for the employee using a new employment ID

- Archive the old employee record

- Retrieve and update the RPNs

- Process the next payment due. The employee should get a refund if they are cumulatively paid.

- Submit the new payments to Revenue in the submission screen.

We suggest verifying which course of active is best for you with a tax practitioner.