Introduction

A new enhanced COVID-19 scheme has been announced. More information about this scheme can be found here:

We do not recommend using the scheme unless you absolutely have to. This is because:

- It is very complex and keeps changing.

- There is going to be another major change on 20 April

- Employees will be taxed on this, just not through payroll.

- Add too much additional payment and Revenue will reduce the subsidy. This could leave employers out of pocket.

- Employees may be better off through social welfare: https://services.mywelfare.ie/en/topics/covid-19-payments/

Employers adversely affected by COVID-19 can either lay off their employees or use the Temporary COVID-19 Wage subsidy scheme. This new scheme supersedes the old €203/week scheme.

As this is a rather complex new scheme, we are aware that the details of the scheme may change at short notice. Due to this, we are trying to make the implementation as flexible as possible. This means that the figures can be over-ridden. If needs be, the scheme can also be set up manually by directly entering the elements.

The Temporary COVID-19 Wage subsidy scheme is a crude emergency scheme and the net pay even with a top up probably will not be exactly the same as it was in previous pay periods.

Setting up the Scheme using the Covid-19 screen

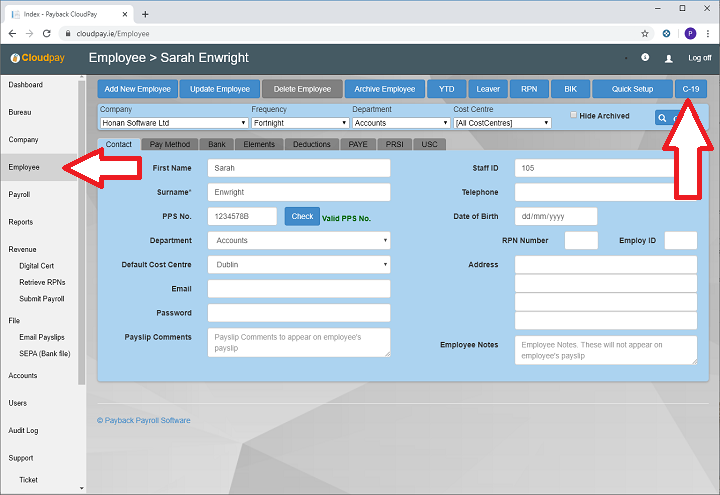

Go to the Employee screen and select the employee you wish to set this scheme up for in the Employee Grid.

Click the new C-19 button at the top right of the screen

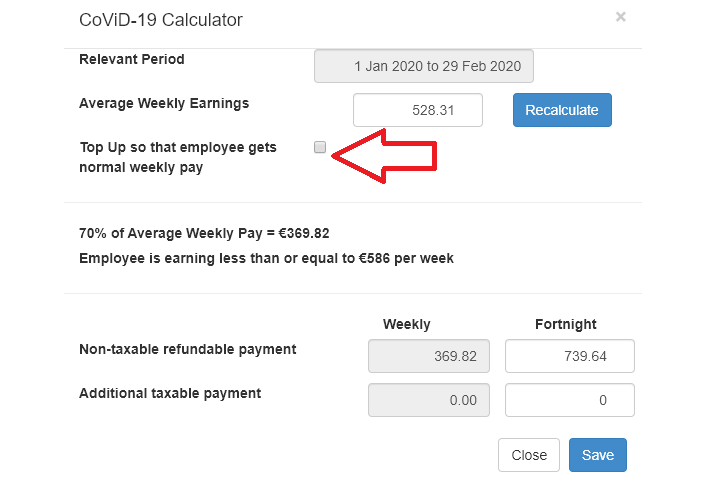

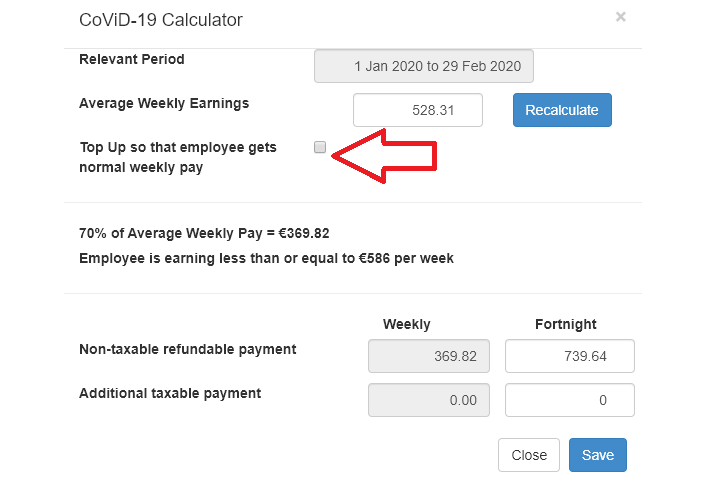

The Covid-19 Dialogue

There are three main tasks:

- Calculate the Average Weekly Net Pay

- Find out if the Average Weekly Net pay is either less than €586, or between €586 and €960

- Reduce the non-taxable refundable payment either to €350 or €410 or 70% of the Average Weekly Net Pay

If you have processed all the payments for the employee between 1 Jan 2020 and 29 Feb 2020, then these figures should automatically fill in.

You may have to click the Recalculate button to refresh the figures.

Adding an additional taxable payment

In addition to the Non-Taxable refundable payment, there is now the option to also pay the employee a top up - which is the Additional taxable payment portion.

You can optionally top up the employee's pay to their usual net pay.

Tick the box shown to automatically calculate this.

It is possible to over-ride this, but if you increase it above the balance of the Average weekly earnings, Revenue will reduce the amount of Refund you will receive

Saving the Changes

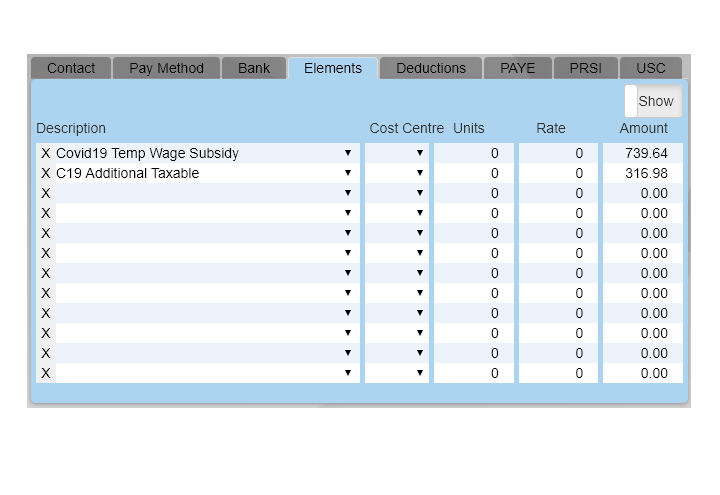

When you click save, the following automatically happens:

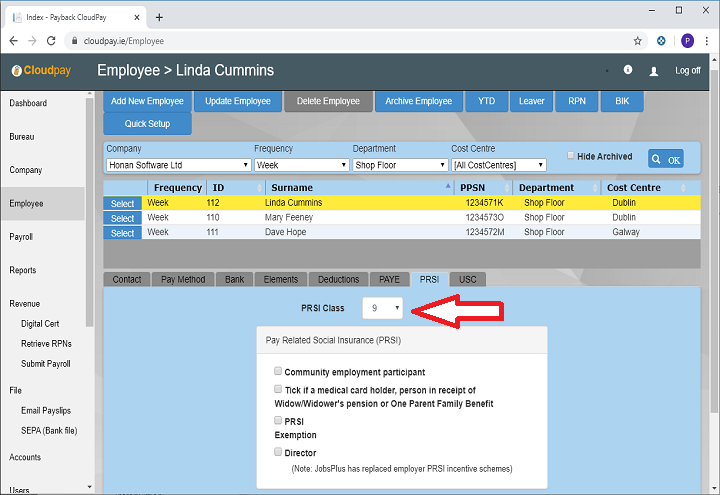

- The employee's PRSI class changes to 9

- The payment method changes to 'Different Amount Each Period', so the Salary or rate details may be lost

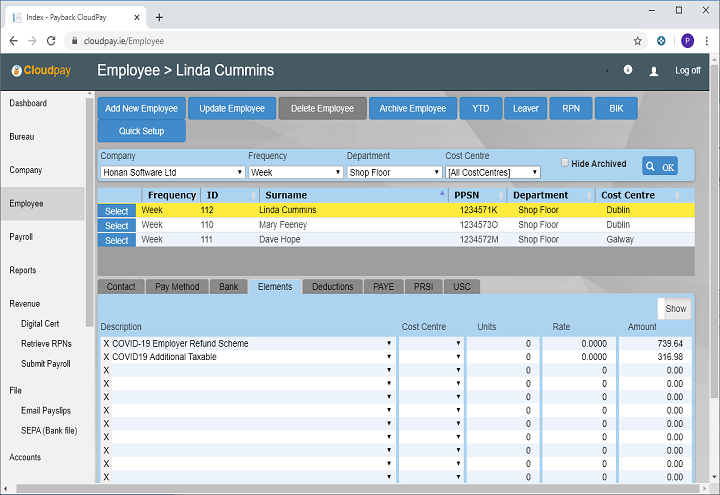

- One, or two new elements are automatically added

Note that the PRSI class is changed to '9'. However, the additional taxable payment is correctly PRSIed using subclass J9. J9 also appears in the Payslip and the Revenue Submission

Manually setting up the scheme

You can also manually set up this scheme as described below. However, we do not recommend doing this.

Manually Setting up Employees

For Each employee on this new scheme, set their PRSI class to 9. When the payment is processed, the subclass will appear as J9 with employee PRSI of zero and employer PRSI of 0.5%

Manually Setting up the Elements

Set up two elements (or just the Refund scheme if you are not topping up) . In the elements drop down you will find:

COVID-19 Employer Refund Scheme

and

COVID19 Additional Taxable

The Refund scheme is the non-taxable through payroll portion and the the Additional Taxable is the optional Employer Top up.

You will have to manually work out the values until the calculator is ready.

DCYA Wage Subsidy Childcare Scheme

For people operating the DCYA subsidy childcare scheme between pay and submission dates between 20 April 2020 to 3 May 2020, you can now top up the subsidy with a taxable payment to bring the employee's payment up to €350 per week.

Cloudpay will allow you to override the additional taxable payment to cater for this.

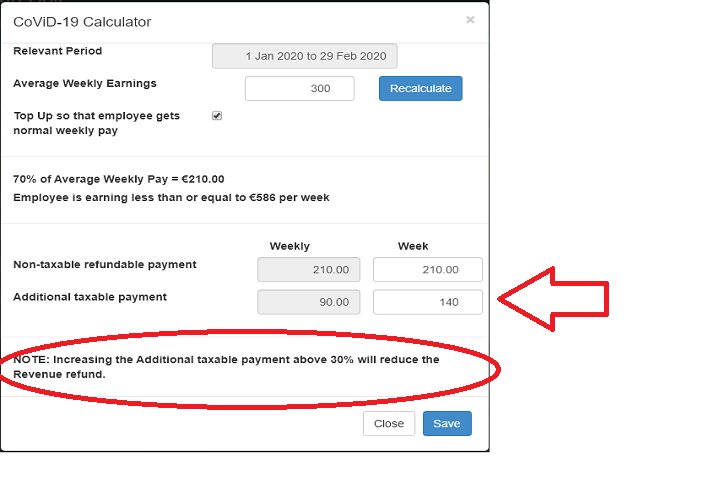

In the example shown opposite the average net weekly earnings are 300. This means that the non-taxable refundable payment is 210, allowing a top up (using the standard scheme) of 90 (210+90 = 300)

Under the DCYA subsidy scheme, the Additional Taxable Payment can now be over-ridden to 140 (which is 350 - 210). Doing this will not taper the subsidy amount.

In summary, over-ride the weekly Additional taxable payment amount to 350 - Non-taxable refundable payment (subsidy) amount. A warning will appear (see circled opposite) but you can safely ignore this for DCYA.

Manually Calculating the Values

If you decide not to use the new Covid-19 screen, you can manually calculate the values.

Work out what the Average Weekly Net is for the employee. Instructions for doing this can be found here, on appendix 1:

The maximum non-taxable refundable payment is €410 or 70% of the employee’s Average Net Weekly Pay if less than €410 for employees earning less than or equal to €586 per week net.

The maximum non-taxable refundable payment is €350 or 70% of the employee’s Average Net Weekly Pay if less than €350, for those earning over €586 per week net and less than or equal to €960 per week net.

The total of the two elements should not exceed the Average Weekly Net

Notes

- The Covid19 Temp Wage Subsidy element is not liable to PAYE, PRSI or USC at time of payment.

- The C19 Additional Taxable element (employer top up) is liable to the usual PAYE and USC rates. For PRSI, the employee rate is zero and the employer rate is 0.5%

- There should not be any other elements or deductions added. Delete any other elements and deductions in the employee screen before adding the Covid Payment.

- LPT, BIK etc, are all suspended for this scheme

- When you process the payment, the Net pay is likely to differ to previous weeks. This is expected and is happening for tax reasons.

- If, for example, the employee normally gets €700 the max the employer can pay without the subsidy being reduced is 30% of 700 i.e. 210. If the employer pays 350 the subsidy is reduced by difference between 350 and 210. So in this case the subsidy would be 210 and that is what should be put in the non taxable field.

Support

If you have any questions about eligibility, part-time employees, if you can add any other payments etc, please contact the Employer Help line: Phone: 01 738 3638 or 1890 254 565 We really do not know the answers, and may give you incorrect information.

There is likely to be huge volume of support over the next week. If you need to contact support, support tickets can be submitted here

https://www.cloudpay.ie/Support

Tickets will be prioritised.

Download a Free Trial

Get started with a free trial. You can process two full payments and be confident that Payback does everything you require at no risk.