Introduction

When you have successfully processed the payments for your employees in the Payroll screen, you can transfer funds directly into their bank accounts. This is done by creating a bank file.

Most Irish banks accept two types of bank file, Paypath (also called Standard 18) or SEPA (Single Euro Payments Area). You can create either format with Cloudpay.

Paypath or SEPA

It can be confusing to work out which file format to use, SEPA or Paypath (also called standard 18). In our experience, the banks do no typically make it easy to determine which file should be used as we often get reports of people using the incorrect format.

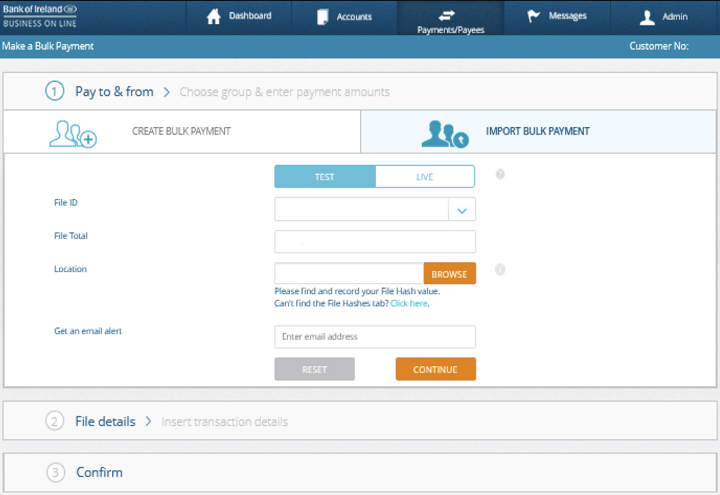

For Bank of Ireland, if you are uploading files to Business Online Payments Plus, then you should use SEPA. These are typically xml files. Instructions for this are here:

However, your BoI file upload screen looks like the one opposite, this is Paypath, and the files are usually .emf, .eft or txt

If you do not know if you should be using SEPA or Paypath, We suggest asking your bank. Users' accounts may also have to be set up to use Paypath or SEPA by their Bank.

Paypath

Paypath Company screen

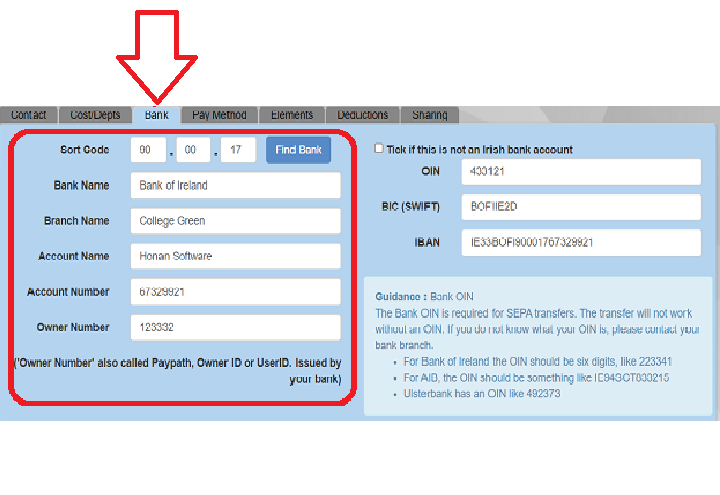

To create a Paypath file, first the Employer bank details should be filled in. This is found in the Bank tab in the Company screen.

The fields at the left of the bank tab are used for Paypath files and those to the right are for SEPA files.

For a Paypath file, you should fill in the paypath fields, including the Owner Number. This is also sometimes called the Paypath number. Your bank will be able to tell you what your Owner number is for Paypath. If you get this wrong, or do not fill it in then the file will not work.

Paypath Employee Screen

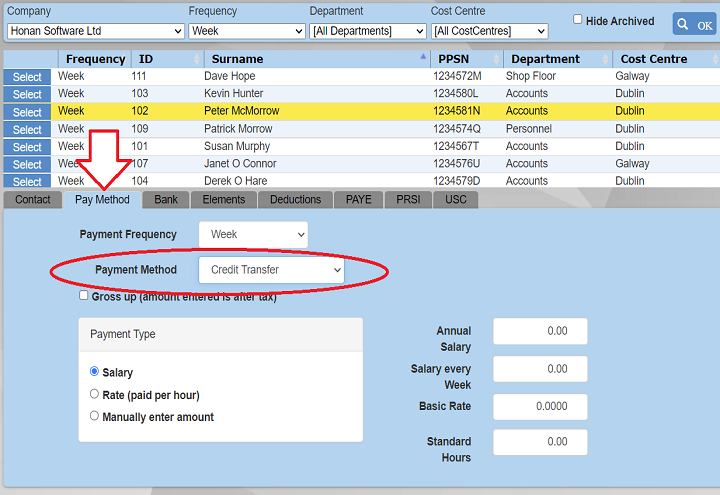

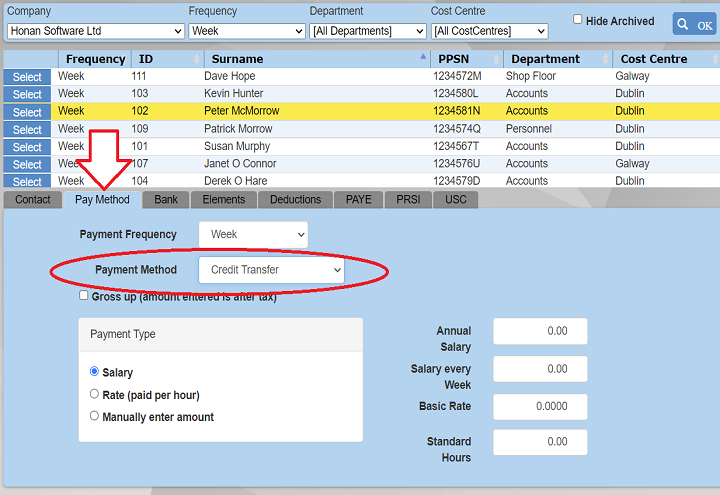

Employees have to be set up with a payment method of 'Credit Transfer' if you wish to include them on a Paypath (or SEPA) file.

Select 'Credit Transfer' in the Pay Method tab of the Employee screen.

Paypath Employee Bank Details

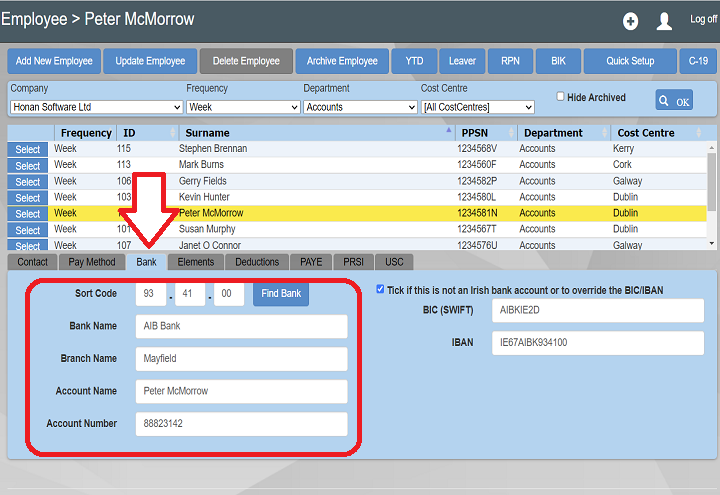

Similar to the Company, each employee you wish to include on the Paypath file should also have their bank account details entered. You can do this in the Bank tab of the employee screen.

The fields at the left of the bank tab are for Paypath.

When you have entered both the company and employees' bank details, you are ready to process the payments, as usual, in the Payroll screen.

Creating the Paypath file

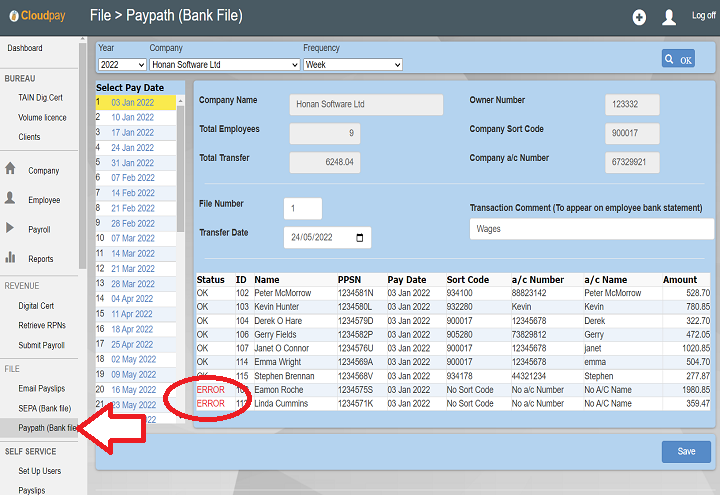

Go to the Paypath (Bank File) screen and select the pay date you have just processed.

You will see all the employees that are to be paid with payment method of 'Credit Transfer' listed.

IF there are any errors, a red Error will appear at the left of the grid. Errors are usually caused by a missing sort code or account number.

When you are happy that everything is okay, click 'Save' to download the Paypath file. This is the file you should use to upload to the bank via your banking application.

Bank of Ireland additional step - Hashtab

For users uploading their Paypath file to Bank of Ireland, there is now an addition step called Hashtab.

Users will need to download an application that will create a hash code for their Paypath file.

The application can be found here:

SEPA

SEPA Company Screen

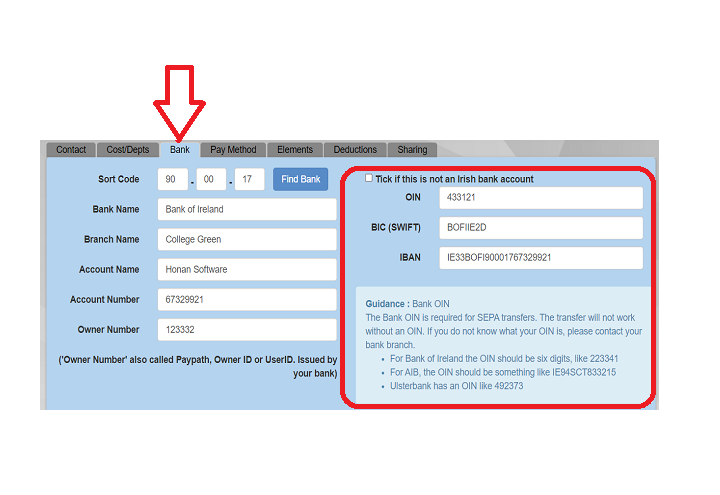

In the Company screen select the company you wish to use to make the SEPA payments. Then click the 'Bank' tab.

Enter the Bank Details for your company and click 'Update Company' at the top of the screen, when you are finished. Your bank details can be obtained from your bank. You should fill all of the fields in the red box opposite.

OIN (Originator Identification Number): The Bank OIN is required for SEPA transfers. The transfer will not work without an OIN. If you do not know what your OIN is, please contact your bank branch.

- For Bank of Ireland the OIN should be six digits, like 223341

- For AIB, the OIN should be something like IE94SCT833215

- Ulsterbank has an OIN like 492373

BIC or SWIFT (Business Identifier Code): 8 or 11 characters that identify your bank.

IBAN (International Bank Account Number): This can be up to 34 characters long, and is calculated from the BIC, sort code and account number.

SEPA Employee Screen

Each of your employees that are to be paid by SEPA also have to have their bank account details entered.

First change their payment method to 'Credit Transfer' in the 'Pay Method' tab of the Employee screen.

SEPA Employee Bank Details

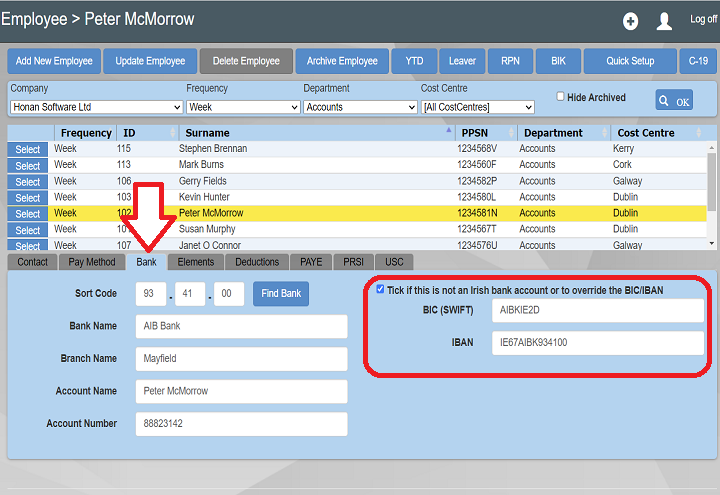

For each employee you will have to enter their BIC and IBAN.

You will need both for the file to be successfully created.

Creating the SEPA file

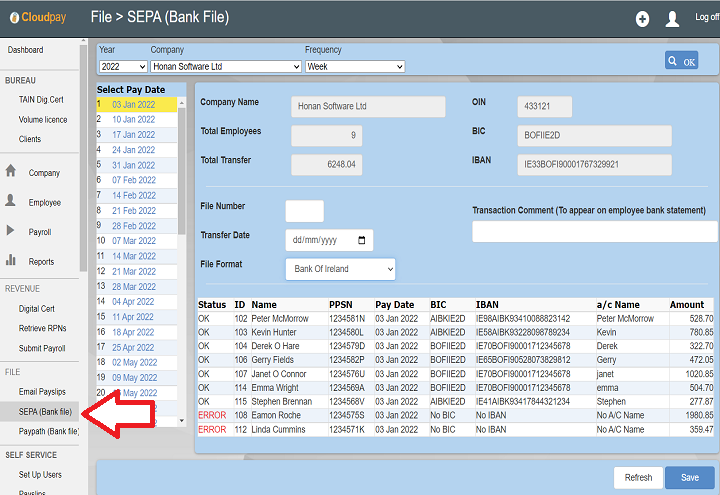

When you have processed all of the payments, you can now create the SEPA file to upload.

If there are any red error messages these must be fixed before the file can be created. IF you change any of the employee's bank details in the Employee screen, click the Refresh button for them to feed through to the SEPA screen.

When you are ready to create the file, click the 'Save' button in the SEPA screen. You will be prompted for a location to save your SEPA XML credit transfer file. Once you have done this, you can send the file to your bank for processing.

Notes

Changes to the SEPA format or other customisation requests.

SEPA is meant to be a standard format across all European banks, and you would expect that what works for one bank would also work for another. However, this is not the case.

Each of the banks have their own version of the format. They look for certain fields to have certain codes or match other fields. The development process took weeks to get this correct (back in 2013). Any small change for one bank can easily break the format for others.

For example, for the field called 'End To End Id', this field must not exceed 18 characters have no spaces, must be UPPERCASE and must be unique. It also must start with 'WG'. If these rules are not met, then the file will fail.

All of the banks in Ireland have their own rules for this. Any changes would have to be tested for all the banks again, and may break the file for other users.

For these reasons we will not make any changes to the SEPA format.