Introduction

Revenue's PAYE Modernisation has unfortunately made the re-employing of employees more complicated. Previously, the same employee record could be re-used, with the leave date deleted.

With PAYE Modernisation, the old employment year to date figures will be included in the RPN, if you try to re-use the old record. This means that the tax may be calculated incorrectly.

Instead, if a Employee that has left returns to rejoin the company, please follow this guidance.

The leaver dialogue

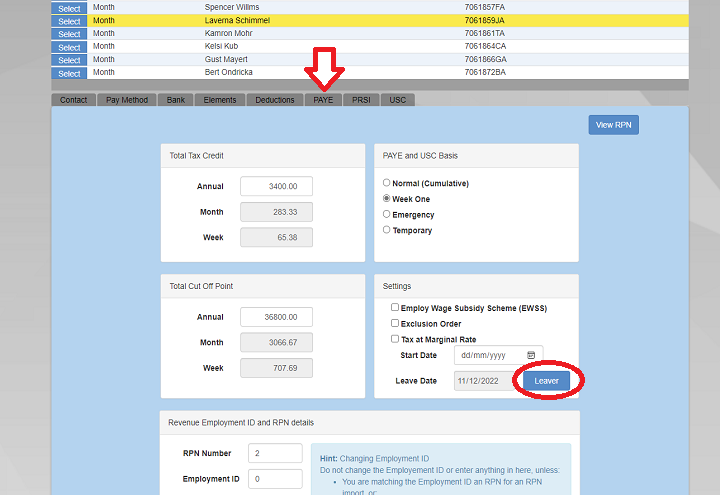

For the employee that has left, and is rejoining, click the Leaver button. You can see this either in the PAYE tab of the Employee Screen next to the leave date, or at the top of the employee screen.

The leaver dialogue will appear.

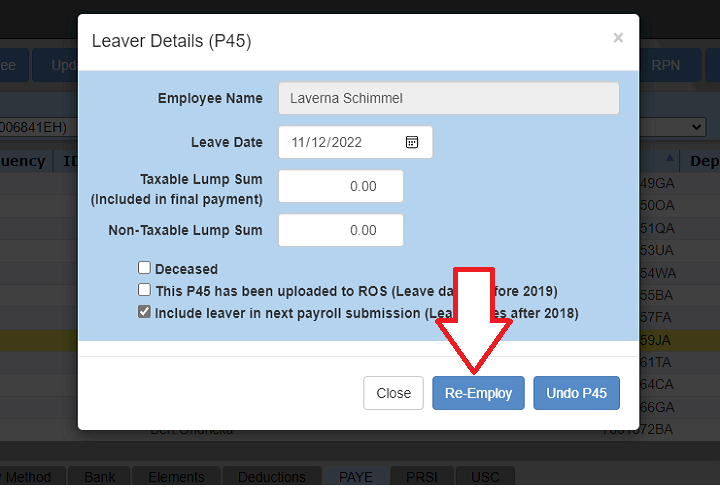

ReEmploy button

In the leaver dialogue, there is a 'Re-Employ' button.

Click this if you wish to re-employ the returning employee.

Note that the re-employ button will only appear if there was a leave date previously entered.

If you previously entered a leave date in error, or an employee that was meant to leave did not, then you can also click the 'Undo P45' button - provided that you have not already submitted the leave date to Revenue.

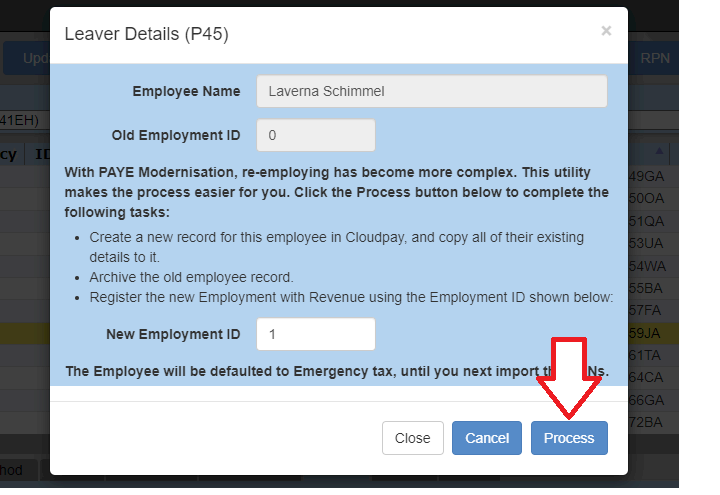

Committing the new employment

Click the 'Process' button. This will:

- Create a new record for this employee in Cloudpay, and copy all of their existing details to it.

- Archive the old employee record.

- Register the new Employment with Revenue using the Employment ID shown.

If the old employment ID was a number, then the new employment ID will be the old employment ID plus one.

If you need to refer to pay slips or payments from the old employment, these are all still stored and available in the old (archived) employee record.