Fixing Errors and Making Changes

Introduction

Mistakes can be easily rectified in Payback. In the past if a user made a mistake while processing payments using other payroll software, correcting would involve a laborious process of restoring old back ups, and possibly losing work.

Payback has a 'rewind' feature that allows payments to be reversed, or 'un-done'.

Payback allows the following:

- Rewind the current processed payment

- Change payments from previous periods

- Rewind and Change payments from previous years

- Bulk Rewind a full year for a single or multiple employees

- Automatically fix P35 errors

Rewind the current processed payment

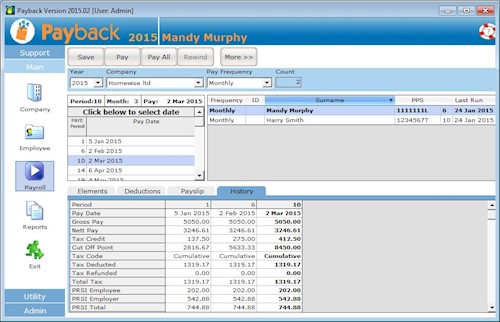

At the top of the Payroll screen is a 'Rewind' button. Clicking this causes the current payment (For the selected pay date and employee) to be rewound, or undone.

NOTE: Bold text means that the payment has not been processed yet. To process a payment, click the 'Pay' button. In the above screen shot, Mandy has not had her 2 Mar 2015 payment processed yet as it is displayed in bold. Her name is bold in the list of employees and in the history grid, the column for 2 Mar 2015 is also in bold. The figures displayed are preview figures. Harry Smith has had his payment for 2 Mar 2015 processed because it is not in bold.

(It is possible to rewind Harry, but not Mandy)

Change payments from previous periods

Payroll is generally calculated on a cumulative basis. This means that previous payments impact PAYE, PRSI and USC that is owed for future payments. For example, if an employee was taxed on the emergency basis for January and then they receive their Certificate of Tax Credits before their next pay then they would probably get a tax refund in their February pay. PRSI and USC may also have thresholds and bands that may be breached during the year that may impact future payments.

This means that payments need to be rewound in reverse chronological order. For Example:

Week 1: 1 Jan to 7 Jan : - Period paid

Week 2: 8 Jan to 14 Jan : Period paid incorrectly

Week 3: 15 Jan to 21 Jan : Period Paid

Week 4: 22 Jan to 28 Jan : Period Paid

Week 5: 29 Jan to 4 Feb : Period Not Paid

Week 6: 5 Feb to 11 Feb : Period Not Paid

...

It is week 5 and a mistake has been noticed for week 2. In order to rewind week 2 to correct the mistake, week 4 and then week 3 first have to be rewound. Payments can only be rewound in reverse order.

The 'Change' button will allow to reprocess a period without first rewinding preceding periods. In the example above, you could follow these instructions:

- Back up your database in case the results are not what was expected

- Select Week 2

- Select the employee in the employee grid

- Click 'More>>' that top of the screen. More buttons will appear

- Click 'Change'

- Make the appropriate adjustment to week 2

- Click 'Submit'

This automatically reprocesses week 3 and week 4. We advise caution using this method because future payments you've already processed for the employee can be changed. The could impact payslips and P30s.

Rewind and Change payments from previous years

To change previous years, Select the year you wish to change from the 'Year' drop down at the top right of the Payroll screen.

Please make sure that you have the correct tax credits, standard rate cut off point, PRSI class and USC rates for the employee for the year you wish to make changes to. You will have to edit these in the Employee screen. When you have finished making the changes for the year, remember to change these rates back.

Payback will automatically use the correct PRSI settings and calculations appropriate to the selected year.

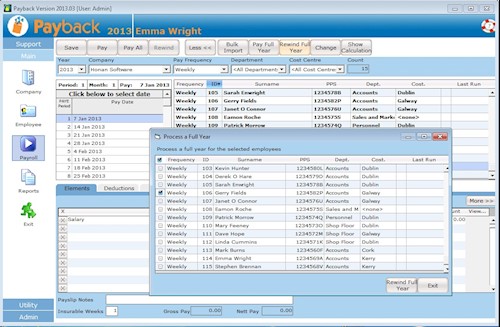

Bulk Rewind a full year for a single or multiple employees

- Back up your database in case the results are not what was expected

- Click 'More>>' that top of the screen. More buttons will appear

- Select 'Rewind Full Year'

- Tick the employee(s) you wish to rewind all payments for the year for

- (Note that you will not be able to reverse this - so make sure the correct employee(s) are selected!)

- Click 'Rewind Full Year'

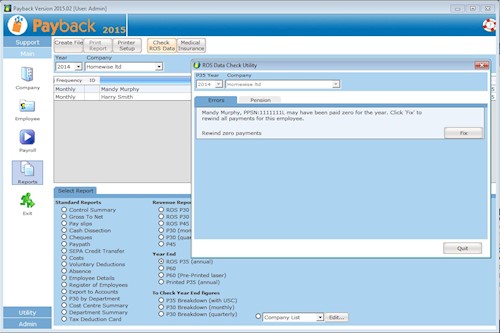

Automatically fix P35 errors

Another way of making changes to payments is via the Check Ros Data facility. This can be found in the Reports screen. Select the year you wish to create the P35 for and then select the ROS P35 (Annual) report. A button will appear at the top of the screen called 'Check Ros Data'. Using this will allow you to quickly make changes to allow you submit your P35.

Example, to fix this error:

ROS ERROR: "Total PRSI is not completed despite liability in the P35L for John Smith, PPSN: 1111111L" "Pay has too small a value in the P35L for John Smith, PPSN: 1111111L"

The above can appear if an employee has been paid zero for the year. This can happen if the user has processed payslips with net and gross pay of zero. It can also happen if an employee has been on taxable maternity where their credits have been reduced. (We suggest contacting Revenue or your accountant to find out how to submit a return for such employees. You may have to fill out a P11:http://www.revenue.ie/en/tax/it/forms/form11.pdf )

Notes

- If you need to change historic data in Payback, please be aware that rewinding/repaying an employee could change their net pay on your version of their payslip, this could also affect the P30 report for the month in question.

- If you are rewinding a large number of payments, or using the 'Change' or 'Rewind Full Year' facility, it is strongly advised that you first back up your database.